Quarterly Commentary: July 2020

View PDF versionInvestment Environment

The ‘Punch Bowl’ has been swiftly topped up!

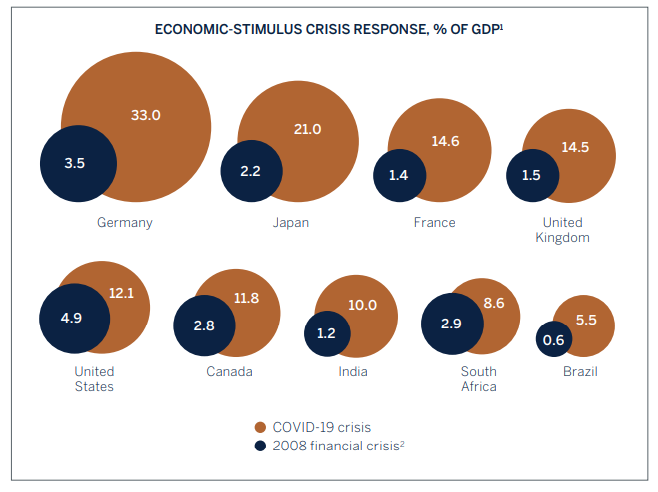

The first half of the year was truly a “tale of two halves”. During the first quarter investors endured significant volatility as Covid-19 concerns resulted in global risk assets such as equities suffering one of the fastest and sharpest declines in history. The impact of the deadly virus on the global economy became a reality for many as governments enforced lockdown measures in order to stem contagion. However, equally impressive has been the sharp recovery in investment markets during the second quarter of the year as policy makers calmed investors by providing the sugar rush or ‘punch bowl’ via truly massive amounts of monetary and fiscal stimulus; multiples of what was experienced in the aftermath of the 2008 Global Financial Crisis. However, it wasn’t just the magnitude of the stimulus that surprised everyone but also the swiftness in which decisions were taken globally.

Across countries, economic-stimulus responses to the COVID-19 crises outsize those to the 2008 financial crisis

2019 GDP taken into account for values related to COVID-19 crisis. Data published by International Monetary Fund in March 2009, includes discretionary measures announced for 2008-10. Source: Global economic policies and prospects, International Monetary Fund (IMF), March 2009, imf.org; government sources; IHS Market; IMF; press search’ The state of public finances; Outlook and medium-term policies after 2008 crisis, IMF, March 2009, imf.org Source: Mackinsey

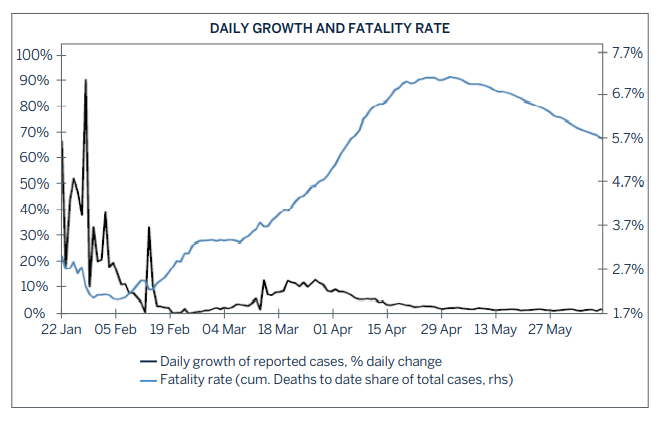

As we head into the second half of the year, economies are starting to recover from very depressed levels as the world once gain gradually opens its doors for business and the stimulus measures take hold. The initial rate of recovery is likely to look powerful as base effects are expected to amplify economic numbers. Despite evidence of a second wave of COVID-19 infections in the US as mobility returns (people returning to their workplaces, visiting shopping malls and eating out at restaurants etc.) the rate of infections on a global basis has stabilised and they are now trending lower in most countries. Further reoccurrence or secondary waves of COVID-19 remain highly probable, but we do not expect country wide lockdown measures to be re-introduced again (given the economic costs), rather more measured and targeted restrictions. Globally, healthcare organisations are also better equipped to respond to the pandemic and are making significant progress in finding more successful treatment plans for patients who have been hospitalised or ended up in ICU, though it will only be the discovery of a vaccine that will ultimately lead to the return of ‘normality’, speed up the global economic recovery process and ensure the sustainability of it.

Source: WHO, Bloomberg

In this month’s edition Craig Smith (Head: Global Healthcare) provides an update on developments surrounding COVID-19.

COVID-19: The rush for a vaccine and improved patient treatment

by Craig Smith / Head Analyst: Global Healthcare

We are now at the half way mark for 2020 but probably some way off the midpoint of the COVID-19 marathon that started “en-masse” in early January. To make sense of the journey so far, it now feels like we are at a point where the imminent threat of Healthcare systems falling over is considerably lower than initially feared. Although, as economies resume some degree of activity, it would be prudent to plan for potential flare ups in new cases and hotspots whilst the world modifies its approach to living with the virus.

The trajectory for the rapid rate of learning about the virus has continued since we last wrote; scientists have now documented over 30,000 papers on COVID-19 for the year to date which gives us hope that the subject is receiving the required medical attention. As a result, one key finding is around the mutation of the virus. It is acknowledged that the SARS-CoV-2 does not mutate as quickly as the influenza virus (which mutates four times faster) and we know that it is relatively stable in terms of its makeup. From a scientific standpoint this is a real positive for developing a vaccine, as you are working against a static target rather than a changeable one.

We also recognise that the healthcare industry is moving at “warp” speed. Collaboration from the scientific community to come up with a remedy is well illustrated by the fact that we are trying to squeeze a lengthy seven-year process for a vaccine into a twelve to eighteen-month period. A cautious, sequenced process is now being parallelised with phase 3 trials being planned while phase 1 trials are still in progress. Large scale manufacturing is being organised “at risk” and distribution networks configured simultaneously. This means that timelines have been drastically shortened for something that would be the fastest ever process for creating a new vaccine.

Operation Warp Speed is a public-private partnership in the US that aims to “have substantial quantities of a safe and effective vaccine available for Americans by 2021”.

Whilst the race for the vaccine receives considerable headline attention, the quest for neutralising antibodies to provide some interim protection should not be underestimated. Coupled with two specific types of testing, for either the virus itself (molecular) or antibodies (serology), temporary immunity will gain greater significance depending on the success and worldwide availability of an effective and safe vaccine. Antibodies appear to be a potentially versatile tool that will most likely be used in milder cases and for prevention in close contact candidates.

Who and what to look out for as we move into the second half of 2020? There are a number of vaccine trial data readouts expected with phase 1 data (low participant, dose-ranging) expected in July and phase 3 data (efficacy, effectiveness and safety within increased numbers of participants) set to be released during the last quarter of this year. Key players to watch here are AstraZeneca/Oxford, Moderna, Pfizer/BioNTech, CanSino and Johnson & Johnson who recently advanced their human clinical trials start date. On the neutralising antibodies (NAbs) side, developments are currently on similar timelines with early readouts expected from July to September. Amgen, Regeneron, Lilly/AbCellera and Vir are the companies to watch here. Ultimately, we need multiple companies to be successful in developing effective therapeutics if we are to keep a real handle on COVID-19 and increase people’s confidence levels to fully re-engage in society.

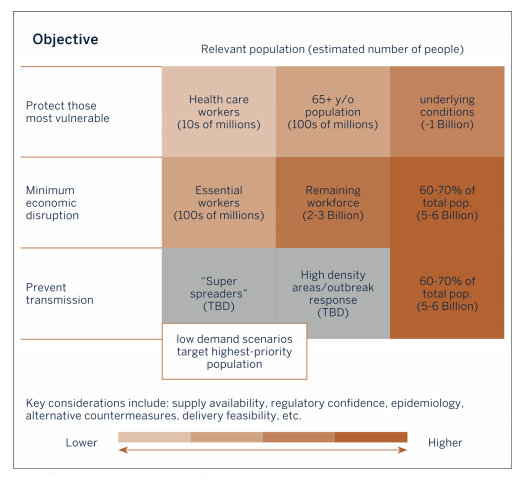

This is all happening while the global economy recalibrates the effort required to sustain itself throughout the pandemic marathon. The threat of the proverbial wall of new cases is very real. However, countries are likely to avoid another complete lockdown scenario at all costs. To date, we see countries as achieving one of the following three outcomes: countries that addressed the pandemic early (Japan, South Korea); countries that suffered significant outbreaks but overcame them (Italy, Switzerland, Belgium); and those who are experiencing a later onset of the pandemic and are now heading towards a peak infection rate (Brazil, India, South Africa, largely EM focused). The US is, in aggregate, still navigating an upward trend with various states having to adjust re-opening strategies. It is still too early to tell which policy measures are most effective without unintended consequences. The exit experiment continues. The healthcare community is in general agreement that managing the disease towards lower rates of infection and mortality will be reliant on a combination of behavioural modification, vaccine, and treatment therapy. Looking further ahead towards the delivery of selected treatments there will in effect be some competition for overlapping capacity. The chart below maps out how different objectives would impact demand and thus vaccine supply chain complexities.

Policy recommendations: potential target populations and requisite capacity vary by public or economic objective

Source: Boston Consulting Group, Bernstein

How does this all relate to our positioning from a healthcare sector perspective? Broadly speaking we have remained overweight global healthcare in offshore portfolios during the pandemic. Typically, during a US presidential election year, pharmaceutical manufacturers and out of pocket spend on drugs are seen as the villain and an easy campaign target for political candidates. However, in the current COVID-19 setting with the spotlight firmly on potential treatments, pharma is now suddenly an integral part of the solution to a path back to normality. Governments are actively supporting these efforts and we see drug pricing pressure dissipating in the near term. Johnson & Johnson and ICON Plc provide exposure to these trends, although we do not anticipate a large commercial benefit resulting from virus vaccine production. Hospitals and medical devices companies are being negatively impacted due to fear of contracting the virus in a hospital setting. In contrast managed care organisations seem to be benefitting from decreased utilisation as procedures are deferred in combination with effective cost control. With five months to go, the US presidential contest will come into focus, the outcome is now less significant for healthcare policy even if Joe Biden (Democratic elected candidate) was to take over the helm from President Trump, given that he is expected to make incremental changes to the Affordable Care Act. Expanding government healthcare insurance programmes will be supportive for both Anthem and UnitedHealth Group.

Risks remain

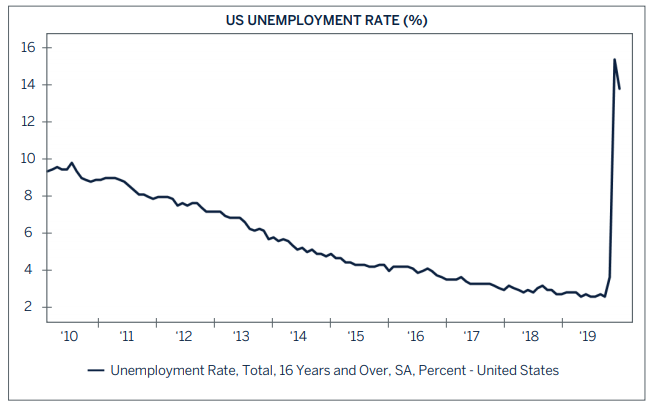

Uncertainty and risks to the improved outlook remain as the world returns to some form of normality. The full consequences of the crisis will only likely reveal themselves in time and it seems unlikely that the recovery in corporate profits, personal income and production output will be complete by the end of 2021. Consumer behaviour after COVID-19 anxiety remains uncertain and the decline in unemployment could be more sluggish than expected due to obsolete businesses.

Source: FactSet

Fiscal support packages in the form of income transfers have played an important role in keeping many companies and households solvent during these trying times. However, debt accumulation by companies has increased exponentially while their revenue intake came to a complete standstill, which is one of the key reasons why we would expect the pace of recovery to be gradual after the initial uptick as many of these indebted companies will not be in a position to fully participate in the cyclical upswing as fiscal programmes cease in the not too distant future. Any disappointment in the pace and sustainability of global recovery is likely to result in a significant increase in defaults leading to considerable headwinds for the financial system and asset prices.

Yet not all risks are linked to the developments surrounding COVID-19. The US presidential election still needs to play out, while trade and political tensions between the US and China will continue to linger. Furthermore, the UK still needs to negotiate the terms of their exit from the EU before year end.

Have global equity markets run ahead of themselves?

In the short-term the answer is probably a resounding yes as unprecedented stimulus by monetary and fiscal authorities globally have resulted in a sharp rebound in risk asset prices since the lows of March. This may be understandable, now that economies are re-opening and infection rates have stabilised, but what has been surprising has been the extent and pace at which prices have increased. Furthermore, asset valuations did not reach the lows usually associated with deep recessions; unusual given that the costs to the global economy from COVID-19 are expected to be significantly worse than any other period of economic decline since WWII.

Source: FactSet

The divergence between the strong recovery in asset prices and ongoing challenging economic fundamentals has been a topical debate, with many investors pointing to the dilemma of “where else can I invest” given that cash and bond income returns have become so unattractive. Even so, cash allocations in multi-asset portfolios around the world are high by historical measures and in the US are sitting at around 25%, a level last seen during the 2008 Global Financial Crisis.

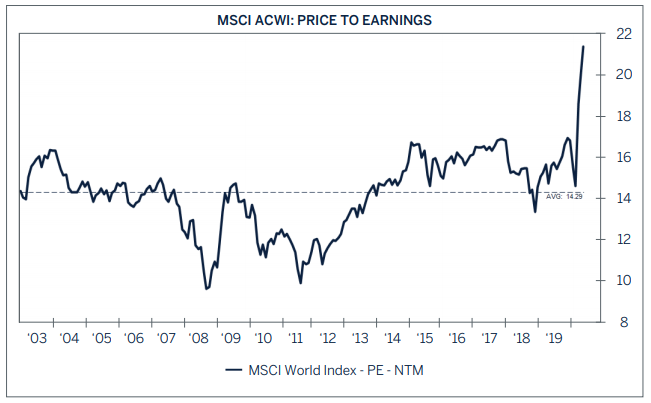

Historically, it has been proven that valuation metrics on their own have not been an important driver of near-term performances but over the long run they remain an important determinant of longer term expected returns.

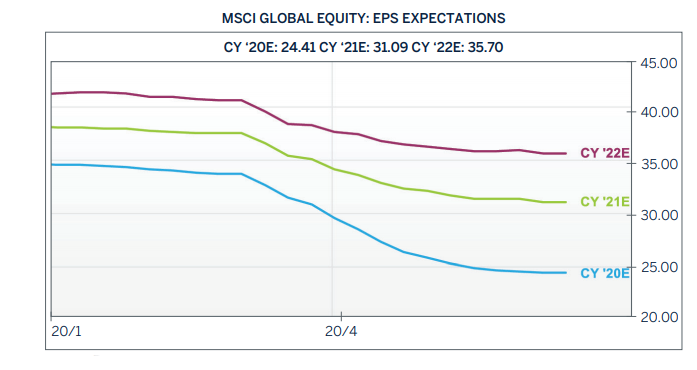

And while valuations for global equities, credit and high yield debt have recovered most of their losses, the outlook for corporate profits has deteriorated considerably since the beginning of this year and are pointing to only a gradual recovery over the next two years. Any further downside to the growth outlook or a slower than expected economic rebound will result in only mediocre equity returns from present levels.

Source: FactSet

Conclusion

Economic indicators have stabilised, and the recovery has generally surprised to the upside as policymakers were extremely quick off the mark to prevent a prolonged recession or even a depression – which is encouraging. High frequency data and economic surveys are now pointing to a much-improved environment during the second half of this year. Although this year’s global recession has been the deepest for many decades it also looks set to be one of the shortest and most memorable in recent history. The pace of recovery will to a large extent be determined by the severity of re-infections and the effects on consumer behaviour. The bounce in investment markets has played an important role in “protecting” consumers wealth (and confidence), even though dividend-and-interest income has been decimated as companies withhold dividend payments and interest rates have been driven to new lows. Furthermore, consumer spending and confidence will also be influenced by the pace of job creation after a period of large-scale layoffs. Without a continued improvement in employment momentum, a gap will be left in personal income once the temporary stimulus programs come to an end, leaving the economic recovery, alongside the recent uptrend in investment markets, vulnerable.

Client portfolios are well positioned and have been adequately diversified to navigate through this global crisis. Within equity, we remain focused on investing in great quality businesses with secular and/or structural growth drivers and strong balance sheets, which allows them to continuously invest and generate attractive and sustained growth for shareholders. Unfortunately, some of these shares are currently trading either at or above their long-term fair values and hence our defensive and underweight positioning to global equities. The underweight position in equities alongside fixed income have resulted in a temporary overweight position in cash, which will be immediately redeployed once investment opportunities present themselves again.

Market Performance %

as at June 2020

|

EQUITIES |

DECEMBER |

Q4 |

2020 |

|

Global |

|||

|

FTSE All World TR Net (Sterling) |

19.57% |

0.37% |

5.18% |

|

FTSE All World TR Net (US Dollar) |

19.15% |

-6.39% |

2.12% |

|

UK |

|||

|

FTSE All-Share TR |

10.7 |

-17.51% |

-12.99% |

|

US |

|||

|

S&P 500 TR |

20.54% |

-3.08% |

7.51% |

|

Europe |

|||

|

Dow Jones Euro STOXX TR |

17.55% |

-11.54% |

-4.51% |

|

FIXED INCOME |

|||

|

Bloomberg Barclays Series - E UK Govt 1-10 Yr Bond Index |

0.98% |

3.09% |

3.54% |

|

Bloomberg Barclays Series - E US Govt 1-10 Yr Bond Index |

0.54% |

5.82% |

7.07% |

|

JP Morgan Global Government Bond (Sterling) |

1.82% |

12.15% |

8.40% |

|

JP Morgan Global Government Bond (US Dollar) |

1.46% |

4.60% |

5.24% |

|

Iboxx Sterling Corporates Total Return Index |

9.03% |

2.89% |

6.52% |

|

Iboxx US Dollar Corporates Total Return Index |

8.69% |

4.89% |

9.07% |

|

CURRENCY vs. STERLING |

|||

|

US Dollar |

0.16% |

7.16% |

2.55% |

|

Euro |

2.64% |

7.27% |

1.51% |

|

Yen |

0.11% |

7.92% |

2.59% |

|

CURRENCY vs. US DOLLAR |

|||

|

Rand |

2.48% |

0.12% |

-1.02% |

|

Euro |

-0.04% |

0.71% |

0.05% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.

Global multi-asset portfolios have largely regained most of their Q1 losses following the best quarter for Global equities since 1998, gaining over 19% in both US dollar and Sterling terms. The UK FTSE All-share index again lagged and remains down -17.51% year to date, leading domestic GBP portfolios to struggle on both a relative and absolute basis for the quarter and year to date. Despite being marginally underweight equities client’s global multi-asset portfolios have performed favourably as we have been actively adapting underlying investments towards quality companies that are prospering as a result of COVID-19, such as technology and pharmaceutical companies. Fixed income mandates posted positive results although underperformed due to our ongoing cautious short duration strategy as risk/return metrics continue to appear unfavourable.

Investment Performance

Global multi-asset portfolios have largely regained most of their Q1 losses following the best quarter for Global equities since 1998, gaining over 19% in both US dollar and Sterling terms. The UK FTSE All-share index again lagged and remains down -17.51% year to date, leading domestic GBP portfolios to struggle on both a relative and absolute basis for the quarter and year to date. Despite being marginally underweight equities client’s global multi-asset portfolios have performed favourably as we have been actively adapting underlying investments towards quality companies that are prospering as a result of COVID-19, such as technology and pharmaceutical companies. Fixed income mandates posted positive results although underperformed due to our ongoing cautious short duration strategy as risk/return metrics continue to appear unfavourable.

Global Asset Allocation

|

Equities |

Underweight |

|

Fixed Income |

Underweight |

|

Cash Plus |

Overweight |

- Equity valuations in aggregate have rebounded and offer little near term upside on a risk reward basis. Low interest rates and positive momentum from improved economic data are however expected to provide an underpin to returns from the asset class in the near term.

- We have successfully been adding to high quality investments during the second quarter but maintained the underweight position to global equities. It is unlikely that the economic and earnings recovery will be completed in the short term, given the extent of pain inflicted from this year’s sudden and deep recession. The long-term impact on consumer spending and the operational costs post-lockdown will only be revealed in time and it is too early to know exactly what the consequences from the current recession will be on final demand.

- Aggressive buying of government and corporate bonds by developed market Central Banks explains the unprecedented growth in liquidity as measured by money supply. The objective has been twofold – first and foremost to support governments and companies raising the necessary funds to deal with the effects from COVID-19, and secondly to make it as cheap as possible to take on new debt, which explains the record low level of income yields available to investors. We acknowledge that bond prices are unlikely to sell-off aggressively in the near term, given the extent of monetary support, but see little value in allocating funds to an asset class where long term returns are primarily determined by coupon rates that at this stage are either below inflation or negative in absolute terms in regions such as Europe and Japan. The maximum underweight to developed market Fixed Income remains unchanged.

- The underweight allocations in both equities and fixed income have left portfolios with an overweight position in cash, which serves as a short-term risk mitigator in portfolios. In addition, the overweight cash position will provide us with ample capital to deploy when more favourable conditions or valuations present themselves.

Global Equities

|

Consumer Discretionary |

Overweight |

||

|

Consumer Staples |

Neutral |

||

|

Energy

|

Underweight

|

||

|

Financials |

Underweight |

||

|

Healthcare |

Overweight |

||

|

Industrials |

Neutral |

||

|

Information Technology |

Overweight |

Materials |

Neutral |

|

Communications Services |

Neutral |

||

|

Utilities |

Neutral |

||

|

Real Estate |

Underweight |

- The exceptional market volatility earlier in the quarter provided us with contrarian opportunities to invest in compelling secular growth businesses. These purchases were funded by exiting positions, such as banks, where operating conditions had suddenly become far more challenging for the foreseeable future.

- One of the new purchases was Orsted. The Danish developer and operator of offshore wind farms is a beneficiary of the global shift away from fossil fuels. The company is installing a third of the world’s offshore wind turbines and plans to double its wind capacity over the next five years. The projected rollout is equivalent to half the average electricity demand across the UK. We researched the company last year but at the time we deemed the share price valuation had been overstretched by the hype surrounding climate-change themed stocks. The indiscriminate sell-off earlier in this year provided the chance to invest within our margin-of-safety valuation discipline.

- Amidst these troubling and uncertain times, we continue to focus on what we can control which is to identify robust businesses with pricing power that can grow under their own steam. They also happen to be precisely the type of companies that are best suited to navigate a persistently sluggish economic backdrop and the rising costs of doing business. The world will be a different place when we eventually return to “normal”, but the companies currently held in our client portfolios will not only survive but thrive in the new competitive landscape.

Global Fixed Income

|

G7 Government |

Underweight |

|

Index-Linked (US Government) |

Overweight |

|

Investment Grade – Supranational |

Overweight |

|

Investment Grade – Corporate |

Neutral/Overweight |

- Despite a strong rally in risk assets during the quarter, US government bonds have traded in an exceptionally narrow range. The natural inclination should have been for ‘safe-haven’ yields to rise in this environment but the bond market remains heavily supported by ongoing robust quantitative easing (QE) measures and the US Federal Reserve’s ‘lower for longer’ forward guidance on interest rates. Whilst economic data appears to be solidly rebounding from the lows experienced during full lockdown, it remains unclear whether the economy will eventually experience a V, U or W shaped recovery. However, we do believe the worst has passed and a resumption to more normal growth levels (however long it takes) will, in time, unleash a major obstacle for the bond markets – namely, the dialling back of unprecedented stimulus measures. Yields at, or close to all-time lows are offering very little protection in the event of this outcome and as such, we remain defensively positioned in respect of duration.

- In the UK, investing in high quality government or supranational issues has become extremely challenging. In the quarter we have seen an increase in fiscal stimulus to the tune of an extra £100 billion in QE taking the total value to £745bn, whilst interest rates have remained at a record low of 0.10%. The reaction in the Gilt market has sent short-dated yields into negative territory, joining their European counterparts, and effectively becoming un-investable. The Bank of England’s Monetary Policy Committee (MPC) has had to fully utilise its war chest to provide much needed support from the COVID-19 induced economic coma. Inflation has fallen sharply as the economy, predominately driven by the consumer, has effectively been closed. However, over the longer term, the combination of massive stimulus efforts and an economy starting to now re-open should lead to higher inflation. For now, interest rate risk is too high to warrant extending durations and our strategies remain moderately overweight corporate credit.

- Investment grade and high yield (HY) corporate spreads tightened considerably in the quarter in line with the resurgence in risk appetite. The short-term direction of risk assets, to which these markets are highly correlated, is clearly uncertain given the recent rally and for this reason, we have only tentatively begun allocating to HY debt in our Melville Douglas managed funds. Over the past twenty years quarterly falls of over 4% in HY markets have always generated a positive return in the subsequent two years – in many cases those returns have been in excess of 20%. History doesn’t always repeat itself but in the absence of yield in developed market government bonds, we view an allocation to HY as a viable long-term opportunity.

Currencies / Interest Rates

RECOMMENDATION - INTEREST RATES

|

CURRENT |

DIRECTION |

||

|

US Dollar |

Overweight |

0.25% |

→ |

|

Sterling |

Neutral |

0.10% |

→ |

|

Euro |

Underweight |

0.00% |

→ |

- In trade-weighted terms, the US dollar still remains positive year-to-date but has surrendered some gains in the quarter. Its negative correlation to the ‘risk on’ environment is clear and perhaps offers some insight into its future direction post-COVID-19. We are cognisant that the US dollar is undoubtedly overvalued but that is understandable given the relative growth and interest rate advantage enjoyed by the US. Taking a medium to long term view, a recovery in the ‘global’ economy will likely weigh on the dollar as other developed economies play catch-up. This should be positive for the Euro which has generally been in a downtrend for over two years now. Any Euro weakness back towards recent lows may be used as an opportunity to build some exposure into dollar strategies, ultimately potentially close to benchmark weight. For now, we maintain the US dollar overweight strategy but are watching closely for opportunities to re-balance.

- UK PLC’s finances are deteriorating with the budget deficit at record highs and debt to GDP breaching the psychological 100% level. COVID-19 has triggered a cocktail of lost tax revenue and increased government spending in the form of fiscal support to both businesses and individuals. Sterling is finding it difficult to make headway given this backdrop and the ongoing BREXIT overhang which has failed to make any material progress. There is no doubt Sterling is undervalued on a ‘purchasing power’ basis, however in the short term it is possible that the currency comes under further pressure. For now, and taking a medium to long-term view, our Sterling International strategies remain moderately overweight, but we are retaining an element of foreign currency exposure as a hedge against any further weakness.

Domestic

South Africa at a crossroad

The impact of COVID-19 and the related lockdown measures enforced by government have been extremely costly to an economy that was already experiencing an economic downturn prior to the outbreak of the global pandemic. In line with global trends, the South African government and Reserve bank have stepped in to alleviate some of the pain inflicted by the crisis, as individuals and companies were starved from income. We will only know in time how successful these interventions have been but suffice to say, given government’s restricted balance sheet, its ability to support the economy will be severely restricted. South Africa’s fortunes, in line with many other emerging economies, is very much linked to global developments and the pace and sustainability of the cyclical recovery in the global economy. In the near term, this should provide some underpin to the manufacturing and export industries as global trade and the supply chains normalise, but this won’t be enough in the long term to save the country from a continued decline in GDP per capita, run-away unemployment and social unrest. The recently announced Emergency Budget (please refer to Fixed Income commentary) painted a bleak picture of government’s debt profile and without an improvement in the country’s growth outlook and/or fiscal austerity measures, SA faces the real risk of further sovereign downgrades and the potential of a funding crisis, in perhaps the not too distant future.

The country has reached a crossroad where difficult decisions can no longer be deferred. Finance Minister Tito Mboweni has assured the public and investors that cabinet has agreed to follow the “narrow[1]road” through the implementing of growth reforms and initiatives to stabilise government’s debt profile - more information will be provided at the Medium-Term Budget Policy Statement. South Africa will lean on funding support from the International Monetary Fund (IMF) to cover the healthcare, income transfers and other costs (such as improved water and sanitation service delivery) associated with the COVID-19 R500bn stimulus package. This lifeline will provide cheap funding to government in US dollars but could also assist in driving change and perhaps even speed up the pace of reforms in an economy so desperate to get off the ground. The conditions of the loan still need to be negotiated between Government, National Treasury and the IMF, but as with any other commitment it is likely that the IMF would be placing pressure on government to implement change. The next few months are critical and will reveal if President Ramaphosa has been successful in consolidating his support base since becoming president, and if he has been able to use the current crisis as an opportunity to implement real change and prosperity for all South Africans.

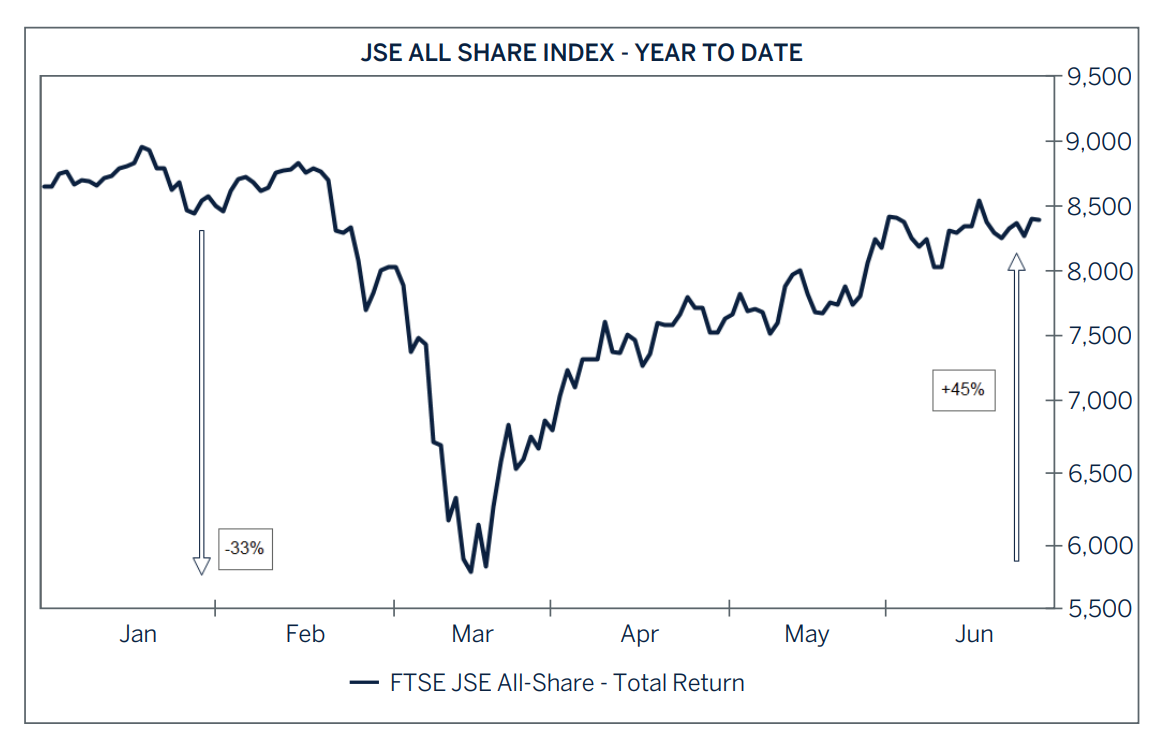

Investment markets recover from COVID-19 lows

South African investment markets have made a remarkably strong comeback in the second quarter as global risk appetite improved and economies re-opened. The JSE All share index increased by 23% and domestic bonds by 10% after the Reserve bank stepped in and lowered interest rates by 275 basis points to support the economy. “Even” the rand recovered from its oversold position in April and has since appreciated by more than 10%. An improved trade balance driven by a positive terms-of-trade, the result of a sharp decline in the oil price (imported) and an increase in the gold price and other commodities (exported) together with an improving current account are expected to continue to provide an underpin to an oversold currency in the near term, particularly as domestic demand remains soft.

But even with the strong recovery, equity investors will have little to cheer about as the overall domestic market is still in negative territory this year and five-year-returns have struggled to even keep up with inflation over the same period – indeed, very unusual and an illustration of the lack of growth and confidence in the domestic economy. In addition, dividends have either been cut or cancelled this year for many companies as the focus has shifted to protecting cash positions and balance sheets. The impact for investors relying on income will be significant and will unfortunately also serve as an additional headwind to aggregate disposable income and hopes of a sharp sustained recovery in economic activity.

The above serves as an important reminder of the importance of regional and asset diversification in portfolios, which have played an important role in not just stabilising but also enhancing returns. Domestic orientated equities have de-rated significantly this year and many financial, property and retail shares are still down by more than 30%, providing attractive entry points for long term investors that can afford to be patient as growth reforms take hold and lower interest rates filter through the economy in the next 12-18 months. A small improvement in levels of business and consumer confidence will go a long way in lifting the country’s growth trajectory. This is not something that we are necessarily banking on and certainly not something that is currently discounted in share prices. Therein lies the opportunity to not only focus on last year’s winners given that some of these assets are no longer that attractive.

Predicting the investment markets can be difficult

We entered 2020 against a backdrop of a global economy that was expected to show steady improvement as the year progressed and of investment markets set to deliver another year of positive returns. These forecasts swiftly changed due to the outbreak of COVID-19. This global pandemic lead governments around the world to enforce strict measures to contain the spread of the deadly and highly infectious virus in their attempt to “flatten the curve”.

The isolation measures enacted across the world has created an external shock to global trade, resulting in a swift and sharp negative reaction in investment markets, the likes of which have not been seen since the 1930s with global equities at one stage down 30% in the quarter. Since the lows experienced in March, investment markets have rebounded strongly given the swift response by Fiscal and Monetary authorities who at the time made it very clear that they would do “whatever it takes” to provide a buffer against the economic fall-out from the crisis.

More recently, the measured reopening of many economies has played an important role in calming investors worst fears. At the end of June, the domestic All Share Index is “only” down 3% and has recovered almost entirely from its lows.

These events serve as a good reminder to overconfident investors that forecasting is indeed very difficult in practice. Who could have foreseen that a virus breaking out in one of China’s large cities could have such devastating effects on global investment markets and resulted in the deepest global recession since WWII.

Nevertheless, irrespective of how nerve wrecking the current episode has been, opportunities always present themselves for patient investors who can hold their nerve. Benjamin Graham once famously said that the “market is like a voting machine in the short term, but in the long run, the market is a weighing machine”. “Mr Market” tends to overreact in the short term to news flow and is obsessed with which investments are either popular or not. Whereas in the long run fundamentals determine the true intrinsic value of the underlying investment.

Another lesson highlighted from this year’s extreme volatility in investment markets is that investors should remain patient and not deviate from their long-term investment goals. In practice, this is easier said than done partly because we are emotional creatures and run the risk of overreacting when the environment deteriorates. Therefore, it is important to get the strategic asset allocation right upfront as this forms the basis for all investment decisions.

There are too many examples of investors taking on too much risk when markets are performing well, only to reduce the exposure to risk assets (such as equity) after the market has already corrected at discounted prices. The importance of prudent diversification, the “only free lunch” for investors, across asset classes, regions and currencies cannot be over emphasized as it provides the necessary stabilisation for portfolios during extreme events.

The table below illustrates the return of a typical Balanced Portfolio (45% ALSI, 25% MSCI ACWI, 5% Global Aggregate Bond Index, 20% ALBI and 5% ZA Cash) alongside each of the underlying asset classes. The outcome from this analysis is that although domestic and international equities have outperformed a Balanced portfolio over the past 15 years (as one would expect), the return profile (as measured by Standard Deviation) of a Balanced portfolio is significantly more stable and predictable, which results in a superior risk adjusted return (Return/ Std Dev) for investors. It is also perhaps worth highlighting that the Balanced Portfolio (as defined above) this year has generated a positive 4.6% return against a negative return of -3% from the local bourse.

| Period: | 2005/07/01 - 2020/06/30 | Risk Adjusted | |

| Investment | % Return p.a. | Std Dev (%) | |

| Balanced Portfolio | 12.0 | 9.3 | 1.3 |

| FTSE/JSE All Share TR ZAR | 12.6 | 15.4 | 0.8 |

| FTSE/JSE All Bond TR ZAR | 8.0 | 7.6 | 1.0 |

| Call Deposit ZAR | 6.8 | 0.5 | 14.1 |

| FTSE WGBI USD | 10.1 | 15.7 | 0.6 |

| MSCI ACWI NR USD | 13.4 | 13.8 | 1.0 |

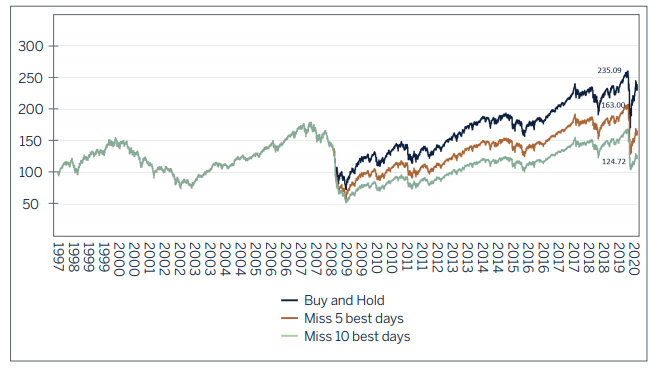

Do not try to “time” the market. It is a well-known fact that spending time in the market is significantly more profitable than attempting to take short term views, partly because the majority of returns are obtained in the period immediately after markets have bottomed (does that sound familiar?). Missing out on a few of the top trading days has proven to be costly for investors.

The charts below are instructive and illustrate why it is so difficult to try and “time” the market and still achieve an optimal return. A buy-and[1]hold strategy provides the most favourable outcome for long term and patient investors. For instance, if an investor missed out on the top 5 trading days since the advent of the Financial Crisis, the difference in accumulated return (brown line) to a simple buy and hold strategy (dark blue line) would have been 44%, and even worse missing out on the top 10 trading days (gray line) would have resulted in a difference of 90% in performance.

MSCI Global Equity Index: Buy-and-hold strategy versus missing the top 5 and 10 days of trading

And finally, although volatility (standard deviation) is generally perceived to be a good measure of the riskiness of investments, we view risk rather as the permanent loss of capital. In other words, only when investors are forced to realise an asset at times of extreme market stress or when an investment has gone “bad” will investors incur a permanent loss of capital.

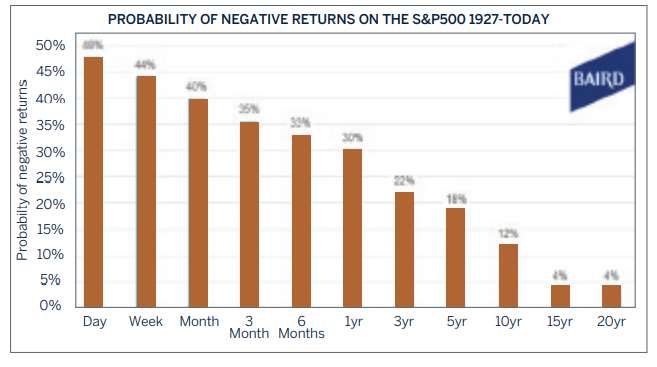

Investors should also take note that the probability of incurring a loss reduces significantly as the investment time horizon increases - a stern reminder that investment in equities requires an extended time frame.

Domestic Investment Performance Market Performance %

June 2020

|

EQUITY |

JUN |

QTR |

12M |

|

All Share Index |

7.7 |

23.2 |

-3.3 |

|

Capped SWIX Index |

7.0 |

21.6 |

-10.8 |

|

Resources |

8.8 |

41.2 |

12.4 |

|

Financials |

3.5 |

13.2 |

-37.0 |

|

Industrials |

8.3 |

16.6 |

4.0 |

|

All Bond Index |

-1.2 |

9.9 |

2.8 |

|

MSCI US |

0.8 |

18.3 |

32.8 |

|

MSCI UK |

-0.3 |

6.1 |

2.3 |

|

MSCI Emerging |

5.8 |

14.9 |

19.0 |

|

MSCI AC World |

1.7 |

16.0 |

25.8 |

|

US DOLLAR RETURNS |

|||

|

MSCI US |

2.2 |

21.6 |

7.8 |

|

MSCI UK |

1.2 |

9.0 |

-17.0 |

|

MSCI Japan |

0.0 |

11.6 |

3.1 |

|

MSCI Emerging |

7.4 |

18.1 |

-3.4 |

|

MSCI AC World |

3.2 |

19.2 |

2.1 |

|

Citigroup WGB Index |

0.6 |

2.0 |

4.6 |

|

Currency vs. US dollar |

|||

|

Rand |

1.1 |

3.4 |

-18.8 |

|

Euro |

1.2 |

1.7 |

-1.2 |

|

Yen |

-0.1 |

-0.1 |

0.0 |

|

Sterling |

0.5 |

-0.1 |

-2.3 |

Domestic Asset Allocation

We highlighted four factors which could assist in stabilizing investment markets and risk appetite after one of the fastest and deepest sell[1]offs in history. The good news for investors is that policymakers have indeed been successful in turning the tide as the recovery takes hold.

Asset price valuations at historic extremes

South African assets, including government bonds, the domestic currency and domestic orientated shares sold off aggressively and in certain cases arguably too much. Even though international shares sold off equally aggressively, valuations never reached the previous recession lows.

A positive turn in leading indicators, such as the global manufacturing and services PMI indices

Forward looking indicators have indeed stabilised and improved from their record lows recorded during lockdown. High frequency data, such as mobility together with certain leading indicators are already signalling a strong recovery ahead during the second half of the year.

A peak in the number of active COVID-19 cases signalling that the efforts to contain the virus have been successful, opening the door to relax lockdown measures and re-open economies

Infection rates have peaked, and the global economic recovery is underway. A second round of infections poses a risk to the trajectory of the recovery but is unlikely to reverse it.

The extent of monetary and fiscal support to buffer the fallout from the government enforced isolation measures

The pace and extent of support from policymakers has been significantly more aggressive than what investment markets had experienced during the Global Financial Crisis.

Domestic Asset Allocation

|

Domestic Equity |

Neutral |

|

Domestic Cash |

Underweight |

|

Domestic Bonds |

Overweight |

|

Global Equities |

Neutral |

- During the quarter we maintained our Neutral position to domestic equities. The earnings outlook for companies has deteriorated and is extremely difficult to forecast in the near term given the extent of uncertainties at this juncture, but a lot of these concerns are already discounted in share prices. Economic conditions in SA are expected to remain challenging and although monetary support should be welcomed, fiscal conditions remain constrained and unlikely to support the economic recovery. While this might be the case, long-term investors have an opportunity to lock in future dividend streams at attractive prices. We do however acknowledge that valuation support on its own will not be enough to drive prices sustainably higher and that an improvement in the outlook for earnings remains critical in unlocking long-term intrinsic value for shareholders. We remain focused on investing in shares with secular growth drivers, instead of companies that are only dependant on the outcome of macro developments.

- We increased the exposure in Fixed Income to Overweight. Foreigners have been exiting emerging markets this year and combined with the country’s sovereign downgrade to non-investment grade resulted in a sell-off in domestic government bond prices. This has provided us with an opportunity to add to clients’ bond exposures at very attractive absolute and inflation adjusted income yields.

- Domestic Cash has been reduced to Underweight to accommodate the increase in Fixed Income.

- We have reduced the exposure to Global Fixed Income given the sharp depreciation in the rand and a strong performance from the asset class on global growth concerns and bond buying programs from global central banks.

- The weighting towards Global Equities has been maintained at Neutral, given the improved outlook for near term growth

Domestic Fixed Income

|

Government |

Overweight |

|

Inflation Linked |

Underweight |

|

State Owned Enterprises |

Underweight |

Following South Africa’s credit downgrade by Moody’s to non-investment grade at the end of March the country was subsequently excluded from the FTSE World Global Bond Index (WGBI) at the end of April. This risk event had a muted impact on the local currency and domestic bond market as the event had been widely expected and had been priced in with foreign investors who long since reduced their exposure to South Africa.

As a result of the slowdown in economic activity, the local bond market experienced severe liquidity challenges due to concerns around debt sustainability and the fiscal position of the country. In response the South African Reserve Bank (SARB) cut interest rates aggressively in the quarter and intervened in the secondary market by buying bonds. The central bank has cut interest rates by a cumulative 275 basis points this year including in a surprise inter schedule meeting on 14 April 2020. Government responded as well to the health crisis brought about by the pandemic by announcing a R500 billion rescue package to soften the economic and social impact of the lockdown. This announcement by the President required the tabling of an emergency budget and the Minister of Finance tabled this in Parliament on 24 June 2020.

Key highlights from the Supplementary Budget

The supplementary budget was much anticipated by the market and of concern to the market, was the issue of mandatory targeted investments (prescribed assets) as speculation was rife that this would feature in the budget. In tabling the supplementary budget, the minister did not mince his words on the fiscal and debt challenges facing the country. He likened our fiscal position to that of a wide-open hippopotamus’ mouth that “threatens to eat our children’s inheritance”. The minister indicated this administration’s determination to “close the mouth of the hippo” and stabilise public debt.

To do so the minister indicated that the Cabinet had agreed in principle to “prepare a set of far reaching reforms” that will “stabilize public debt”. Importantly the National Treasury will henceforth adopt a zero budgeting approach in drafting the national budget. This will require that for every expenditure item by national and provincial departments as well as local spheres of government, to make it to the national budget be justified as opposed to the current system where the previous’ year’s budget is used as a base. This is aimed at improving budget efficiency and curtail wastage. The minister indicated that all these proposals will find expression in the Medium-Term Budget Policy Statement (MTBPS) in October. Effectively the supplementary budget provides a bridge to this year’s MTBPS. Below are some of the key highlights from the special budget.

Domestic Fixed Income

- The Budget deficit in 2020/21 is expected to exceed R300 billion due to poor revenue collections.

- In 2020/21 the consolidated budget deficit will be revised from 6.8 per cent of GDP projected in the February 2020 Budget to 15.7 per cent of GDP.

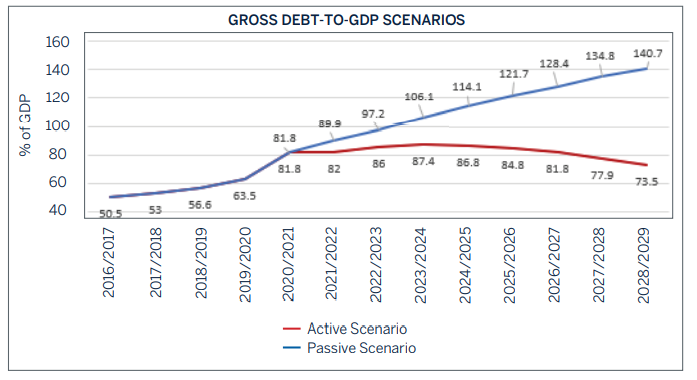

- The gross debt-GDP ratio is lifted to 81.8% in 2020/21, which is significantly higher than the 65.6% projected in the February 2020 Budget, but a peak is now envisaged at 87.4% in 2023/24. This addresses the market’s concern in the February Budget about a lack of (projected) debt stabilisation.

- The special adjustments budget includes an additional allocation of R3 billion to recapitalise the Land Bank with No Other in year spending adjustments proposed for state-owned companies (SOEs). This is an important development from the National Treasury as it signals that no additional financial support will be extended to SOEs without a credible business plan.

- No mention was made of mandatory targeted investments (prescribed assets). The absence of reference to prescribed assets in the budget may be a strong signal that government is not keen on going down this route. Government would prefer an amendment to Regulation 28 of the Pension Funds Act to make it broad and flexible on inclusion of alternative assets.

- Treasury expects a significant portion of the extra required funding to come from foreign loans (mainly from multinational institutions including the IMF, World Bank and New Development Bank), the utilisation of sterilisation deposits and higher short-term borrowing, an envisaged further increase in weekly bond issuance mainly concentrated in the 7-10 year area of the yield curve. The involvement of Development Finance Institutions such as the IMF in the funding mix , though less stringent, at this stage may provide the catalyst to spur the urgent reforms required to avoid a debt trap and fiscal calamity.

- Government has adopted an “Active Approach” to debt stabilisation and more information will be presented at the MTBPS in October.

Approach to debt stabilization (passive vs. active scenarios)

Domestic Fixed Income

The minister in his speech painted two scenarios to debt stabilisation, a passive approach where debt is left to spiral out of control and an active approach where the fiscus is managed prudently and debt is brought under control. Government has adopted the latter and under this approach government has highlighted the following:

High road to debt stabilization (Active Approach)

- Cabinet has endorsed the target of a primary surplus by 2023/24, meaning revenue will exceed non-interest expenditure.

- Spending reductions and revenue adjustments amounting to approximately R250 billion over the next two years.

- National Treasury will introduce zero-based budgeting from the October MTBPS under which all spending programmes would have to be re-justified and reconsidered with each iteration of the fiscal plan.

- Main budget expenditure is now projected to increase to 37.2% of GDP in 2020/21, relative to the 2020 Budget estimate of 32.5%. This reflects the response to COVID-19 and higher debt-service costs.

Risks to consolidation and High Road to recovery and conclusion

- Minister Mboweni reiterated that the expansion of social grants would be terminated by October. Given the rising levels of poverty and inequality in the country and that have been accentuated by the effects of the pandemic, there is an upside spending risk in this item as it may be difficult to terminate this expenditure item. We envisage political headwinds to the bold policy reforms and public sector wage reduction plans remain unclear. The minister in his speech jokingly alluded to the difficulties faced by government in negotiating this expenditure item down. Given skills and capacity constraints of the State, execution risk and capacity to deliver always lingers.

- Given the risks highlighted above, we believe bond yields will remain range bound and that the MTBPS in October will be a key determining factor to bond yields and currency trajectory. The South African bond yield curve remains very steep, (meaning the gap in bond yields between the long and short end remains wide). The expected selloff of long bond yields as a result of funding concerns should be muted due to supply demand dynamics as government plans to issue mainly in the belly of the curve (7 – 12 year). The belly of the curve remains the most liquid area of the curve and extra issuance in this area will enhance this sector’s liquidity. Consequently, we expect this area to be best performing going forward and funding concerns to continue being expressed in the long end of the curve.

- Our fund strategy going forward is to be long duration overall and tilt our long exposure to the belly of the curve and maintain a relative short duration position in the long end of the curve. The SARB, despite its aggressive and deep cuts so far this year has indicated its willingness to give further monetary policy support to the economy should the need arise. This could very well be offset by fiscal austerity measures as government tries to arrest the rising public debt. We however believe the interest rate cutting cycle is getting close to bottoming.

Domestic Equities

|

Basic Materials |

Underweight |

|

Financials |

Overweight |

|

Consumer Goods |

Overweight |

|

Consumer Services |

Overweight |

|

Technology |

Underweight |

|

Telcos |

Underweight |

|

Industrials |

Overweight |

|

Healthcare |

Underweight |

- SA equities staged a solid recovery in April and June. In the second quarter of 2020, SA equities were the best performing asset class. The JSE Capped SWIX had an exceptionally strong second quarter, returning 21.6%, compared a negative return of 26.6% for the first quarter of 2020. April 2020 was particularly strong as markets formed expectations about the effects of the global lockdowns. In addition, we had announcements of unprecedented fiscal and monetary policy measures from nations around the world. These measures combined with the opening of economies spurred a risk on trade which sent global and local stock markets flying. This of course was not without volatility which remains very elevated as news flows begins to provide insights as to the real damage in global economies. The most positive piece of news was the US jobless claims at the start of June which pointed towards the US creating jobs as the economy opened. On the negative side of the equation, COVID-19 cases globally continue to rise and there are fears around the secondary effects of the virus on economies.

- In South Africa, we were downgraded to junk status by Moody’s towards the end of quarter one. The money flowed out of South Africa towards the end of April 2020 which saw a large sell off in bonds and the local currency. South Africa is expected to lag the global economic recovery given the fiscal position of the country pre lockdown and the lack for fiscal flexibility of the South African Government.

- Over the last year, the Naspers and Prosus stable combined with the PGM and Gold space was the only place to be. During the second quarter of the year, basic materials continued their strong performance, returning 41% lead by the precious metals and gold counters. The technology sector returned close to 25% as the sector is dominated by Naspers and Prosus which had a very strong quarter off the back of the Tencent share price. Property had a large bounce, returning around 16%. The return was somewhat of a relief rally post an exceptionally poor run. All the other sectors were also positive, capping off a very strong quarter for South African equities.

- The South African economy is expected to lag the global recovery. Despite this, there are many high quality South African counters that will benefit organically and acquisitively on the other side of the recession as not all companies will survive the current economic downturn unfortunately. Our portfolios are focused on counters with very strong business models, balance sheets and free cash flow. These counters will have opportunities post the economic fallout and many of them are not reflecting their intrinsic value at this point. Now, more than ever, stock selection and diversification are paramount.