Quarterly Commentary: Q3 2020

View PDF versionVolatility sets in as growth momentum rolls over

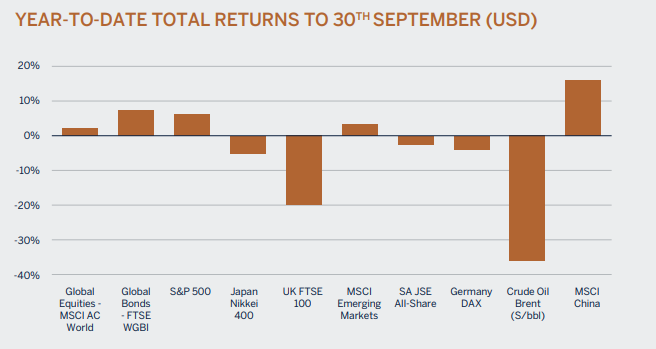

2020 has truly been a roller coaster ride and has tested the nerves of even the most experienced and sanguine of investors. After one of the sharpest and swiftest market sell-offs and severest and deepest recessions in history, global equity markets, as defined by the FTSE All World TR Index, have rebounded by more than 50% from their lows seen in March leading the index to be in positive territory on a year to date basis. Indeed, very unusual, but a function of the sheer magnitude of fiscal and monetary policy stimulus measures implemented to stave off what could have been a much more prolonged and painful recession. However, not all markets have recovered with the UK FTSE All Share TR disappointingly still nearly -20% year to date whilst investment markets also lost some steam towards the end of the third quarter as certain forward-looking growth indicators in the services sectors (predominantly hospitality and tourism) trended lower in regions that experienced an increase in coronavirus infections.

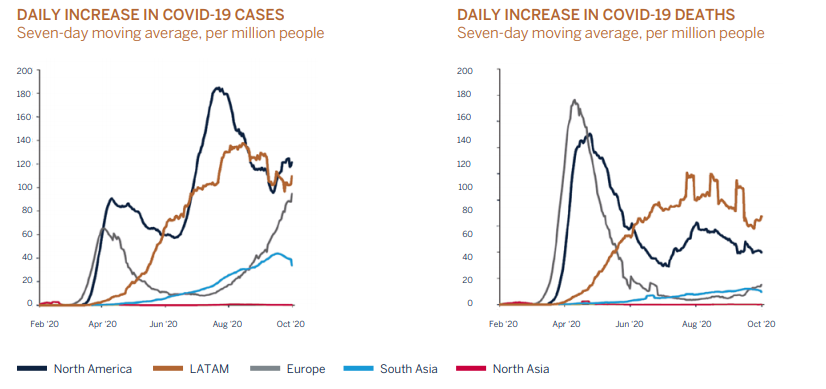

A resurgence of infection rates led to economic headwinds as the re-introduction of social distancing measures were implemented in these regions. Furthermore, risks to additional fiscal policy support have increased in the US as the House Democrats and White House couldn’t agree on the terms of additional income support for individuals and small businesses that were negatively affected by the lockdown measures. This has raised concerns about an abrupt slowdown in consumer spending which will make the prospects of a full recovery even more distant.

Source: FactSet

Source: JPMorgan Asset Management

The good news is that although cases have been increasing at a brisk pace a significant component of the increase can be explained by an acceleration in testing. In addition, the fatality and hospitalisation rates are currently a fraction of what they were earlier this year because new infections are skewing towards younger and less vulnerable populations, with the result of much less pressure on healthcare systems. At the same time, older (and less economically active) individuals appear to have been self-shielding, as they recognised the increased risk they face. Medical treatments for COVID-19 have also advanced rapidly and played an important role in reducing the severity of illness and mortality rates. Collectively these are important developments which will reduce the pressure on politicians to enforce the same draconian measures that were implemented during the onset of the pandemic when the motivation at the time was to limit pressure on healthcare systems and prevent increases in mortality.

It is therefore highly likely that governments will accept modest levels of infections as a necessary cost for maintaining a certain level of economic activity. This is especially the case now given that the current wave of infections looks very different given that the majority of cases are either mild or asymptomatic, which allows governments to be more specific in their approach towards containing the spread of the virus, instead of implementing broad based shutdowns of economic and social activity.

The discovery and approval of a successful vaccine/s as a means to strengthen herd immunity levels will be a game changer and assist in speeding up mobility rates and in turn the economic recovery and news on this front has been rather encouraging. Vaccines normally require around a decade to become operational but given the pressured timeline it is now expected that a vaccine could be approved as early as next year. Even though there is sure to be manufacturing and distribution challenges that will need to be overcome, the approval of a vaccine bodes well for a sustained improvement in economic activity and there is increased confidence that this will materialise sometime in 2021. In the interim with real growth expected to be lower equity investors must expect increased levels of volatility and lower returns going forward whilst they will have to be increasingly selective in their investment making decisions.

Conclusion

The abrupt change in direction in investment markets is a reminder of just how fragile and dependant financial markets have become on stimulus measures as well as the outlook for COVID-19 infections, but it also highlights the importance of being patient and selective when making investment decisions as growth in the future will likely be more constrained in a world with bloated balance sheets and a change in consumer behaviour given the virus.

The combination of elevated valuations across all asset classes (a function of low interest rates), uncertainty surrounding the up-coming US presidential elections, prospects of a hard BREXIT, and a slowdown in growth momentum due to a pick-up in infections and the removal of fiscal support are sure to provide a fair dose of volatility in the near term. Volatility does however provide investment opportunities, and investors will do well to stay the course and focus on the fundamentals which have been improving as the global economic recovery takes hold (even though it may be bumpy at times) and not be swayed by the short term noise which can be overwhelming.

Our investment approach, irrespective of the environment, is to focus on fundamentals while assessing the risks that we are being presented with, and to not be influenced by daily market movements or momentum. We will continue to ensure that portfolios are adequately diversified to navigate through what could be a more volatile period lying ahead of us as the year draws to a close.

Investment Performance

Despite a weaker end to the quarter and being marginally underweight equites client’s global USD and GBP multi-asset portfolios enjoyed another strong period aided by gains in global equity markets. However, again the UK FTSE All-share TR index lagged falling by -2.92% for the summer period leading to a decline of just under -20% year to date leading domestic GBP portfolios to once more struggle on both a relative and absolute basis for the quarter and year to date. We continue to actively adapt underlying investments towards companies that remain well positioned to both survive and prosper despite COVID-19. Fixed income mandates were flat to slightly positive during the period and were broadly in-line with benchmark. On a year to date basis positive returns have been delivered although some underperformance has been seen due to our ongoing cautious short duration strategy as risk/return metrics appear unfavourable.

Asset Classes

|

Equities |

Neutral |

|

Fixed Income |

Underweight |

|

Cash Plus |

Overweight |

Asset Allocation

We have recently made use of volatility in investment markets to tactically increase the equity exposure to Neutral from a one notch underweight position previously. The change in allocation was primarily driven by our belief that following recent central bank comments interest rates will be kept low for a prolonged period and continue to provide an underpin to valuations while the economic recovery takes hold. Following its latest meeting the US Fed has indicated that they expect interest rates to remain unchanged until 2023 and signalled that the tolerance to inflation has become more balanced, given their “new” 2% average inflation targeting objective accompanied by maximum employment. This view is very much supported by central banks globally. The outlook for earnings growth has also improved in line with economic fundamentals, with an expectation of a strong rebound over the next year. Although we don’t expect future returns to be in line with the expected recovery in earnings given the already strong recovery in share prices, we would expect the asset class to outperform both cash and fixed income securities over the next year.

Government and corporate bonds have been, and still are, very much supported by the aggressive buying from developed market central banks, which has in turn resulted Asset Classes Equities Neutral Fixed Income Underweight Cash Plus Overweight in much lower market interest rates and strong growth in liquidity as measured by money supply. These measures will probably continue for a while longer and have served their purpose in providing companies access to liquidity as well as lowering the cost of funding to record low levels. Although these events bode well for borrowers, that is not necessarily the case for bond investors who will be receiving unusually low to negative absolute and real yields on their capital. We are comfortable to maintain a maximum underweight position to developed markets bonds. In addition, volatility this year has afforded us an opportunity to cautiously accumulate Credit and High Yield in the fixed income strategies to enhance returns.

The neutral position in global equities and maximum underweight in fixed income have left portfolios with an overweight position in cash, which serves as a risk mitigator in portfolios. In addition, the overweight cash position will provide us with ample capital to deploy when more favourable conditions or valuations present themselves.

Equities

|

Consumer Discretionary |

Overweight |

|

Energy |

Underweight |

|

Financials |

Underweight |

|

Healthcare |

Overweight |

|

Industrials |

Neutral |

|

Information Technology |

Overweight |

|

Materials |

Neutral |

|

Communications Services |

Neutral |

|

Utilities |

Neutral |

|

Real Estate |

Underweight |

With the global economy unlikely to be firing on all cylinders for quite some time, a valuation premium will continue to be assigned to those companies that can sustainably grow their earnings. This is particularly the case in a world where almost every industry is being disrupted by a reshaped competitive landscape. Our investment philosophy focuses on identifying the winners.

We are mindful about the high valuations attached to quality growth stocks. Trees don’t grow to the sky, and neither do share prices. The risk of overpaying or being blindsided by the unexpected is mitigated in client portfolios through:

/ A conservative bias when making long-term earnings projections.

/ Healthy scepticism about assigning higher “it’s different this time” valuations relative to history.

/ Purposeful diversification by sector, theme and geography.

In other words, we guard against falling in love with a successful investment by constantly challenging its place in the portfolio and by incorporating a margin of safety in our analysis.

Amphenol is a recent purchase. The company manufactures connectors that are critical for ensuring power is transmitted in an electronic circuit. It is easy to see the secular growth in “connectedness” continuing for many years and decades to come as a result of the proliferation of electronics in more and more products. Crucially, it is nigh impossible to displace Amphenol’s mission-critical components once they have been designed into a product. In addition, the company is highly diversified by end markets, making it less obviously prone to rapid technological disruption. All these strengths are evidenced by a consistent and long track record of strong cash flow growth.

Fixed Income

|

G7 Government |

Underweight |

|

Index-Linked (US Government) |

Overweight |

|

Index-Linked (US Government) |

Overweight |

|

Index-Linked (US Government) |

Overweight |

|

High Yield |

Overweight |

Economic data releases have been upbeat but past activity does not guarantee a lasting theme – at least at the current pace, which remains flattered by recoveries from down levels. The Federal Reserve recently tweaked their mandate with regards to inflation and now seek that it ‘averages 2% over time’. This has implications for the interest rate outlook, signalling that rates will remain unchanged even if faced with inflation rising above target. Near-zero interest rates and the ongoing pandemic should, in theory, add to the attractiveness of the government bond market but yields at current levels have factored much in and allow little in the way of a safety net in the event of higher inflation and an ongoing economic recovery. Vast money supply creation may contribute to higher inflation in 2021 and if vaccine hopes becomes reality, a ‘risk on’ mood should pervade. If this unfolds and the economy successfully navigates this terrible episode, then attention will quickly turn to an eventual dialling down in stimulus measures. This could be particularly damaging to government bond yields which at current levels are not priced for this scenario. As such, we remain defensively positioned with respect to duration as only marginally higher yields on longer-dated debt are not nearly enough compensation for the added risk.

In the UK, the sugar-rush from stimulus measures and easing of lockdown restrictions seems to be running out of steam. Whilst key economic data releases point to a healthy expansion, albeit from a very low base, more recent indicators for both the manufacturing and the services sectors are off the highs experienced in July. There is no doubt that the potential for the recovery to slow, or even stall, has risen following the Government’s new restrictions as COVID-19 cases again climb. The Monetary Policy Committee (MPC), continue to hold interest rates near zero, however there is increased speculation that the MPC may, at some stage, implement negative rates. We are not yet convinced, the lesson from Germany is that this highly unconventional policy can be very difficult to reverse and can quickly have diminishing positive effects. However, it appears the bond market has already made up its mind on this matter with UK Gilt yields already trading in negative territory out to seven years in maturity. Negative or not, we do know that an almost zero interest rate policy will be with us for quite some time.

The recovery in Investment Grade (IG) and High Yield (HY) corporate bond markets has been dramatic following severe capital declines in March and spreads are edging closer to pre-COVID levels which certainly doesn’t appear to make them look cheap. However, the environment for both taking risk and yield hunting remains supportive. Central bank initiatives have increased the allure of riskier fixed income assets and those that can pay an income stream above government debt are greatly benefitting as the world remains starved of yield. One could argue that the global marketplace’s reliance and in many respects complacency towards central bank support is possibly creating a bigger issue down the road, and this is entirely plausible. However, the past six months has clearly demonstrated the pitfalls of being too risk averse in an environment where the central bank ‘has your back’. We continue to hold IG debt with a smaller allocation to HY in our fixed income strategies and any upcoming weakness may persuade us to increase weightings to both.

Currencies

Interest Rates

RECOMMENDATION - INTEREST RATES

|

Current |

Direction |

||

|

US Dollar |

Overweight |

0.25% |

→ |

|

Sterling |

Neutral |

0.10% |

→ |

|

Euro |

Underweight |

0.00% |

→ |

The US dollar has posted a negative quarter with virtually all of the downside attributed to the month of July. Ultimately, the currency was due a period of consolidation but where do we see direction from here? Firstly, it is important to appreciate that the currency, in general terms, is only down approximately 2.5% year-to-date and in fact, the relative outperformance of the US bond market versus the German bond market (as an example) has more than compensated for the currency’s depreciation against the Euro. Without doubt, the outlook for the US dollar is negative if other developed economies (Eurozone, UK etc.) enjoy periods of economic ‘catch-up’ but we are not currently seeing enough evidence of this. The US still enjoys a solid advantage in this arena and is backed up by a central bank that seems willing to pull out all the stops to stimulate growth. The US dollar has defied the ‘demise of the dollar’ story time and again, and whilst it may well be different this time, it will not be a one-way street. It is crucial to remember both the performance and yield (often negative) of the asset class underlying each respective alternative currency – we remain overweight for now.

Sterling has been somewhat resilient over the quarter gaining approximately 4% against the US dollar, although more recently has given up some ground from the September high of $1.34. Sterling strength has been more attributed to US dollar weakness rather than broader support for the currency as it struggled to rise against other currencies, especially the Euro. We have commented for some time that Sterling is undervalued on a purchasing parity basis and over the long-haul, should regain some footing. However, current headwinds from the resurgence of BREXIT uncertainties, particularly with a year-end deadline fast approaching and still no deal in sight, combined with heightened restrictions to control the increasing spread of COVID -19 is likely to keep volatility elevated. Our Sterling International fixed income strategies remain moderately overweight base currency, but it is still too soon to exit the foreign currency exposure which sits as a hedge against potential shorter-term weakness.

Global Market Performance %

as at September 2020

|

EQUITIES |

Q3 |

YTD |

12 MONTHS |

|

Global |

|||

|

FTSE All World TR Net (Sterling) |

3.30% |

3.68% |

-5.15% |

|

FTSE All World TR Net (US Dollar) |

8.08% |

1.18% |

-10.31% |

|

UK |

|||

|

FTSE All-Share TR |

-2.92% |

-19.92% |

-16.59% |

|

US |

|||

|

S&P 500 TR |

8.93% |

5.57% |

15.15% |

|

Europe |

|||

|

Dow Jones Euro STOXX TR |

0.67% |

-10.95% |

-6.19% |

|

CURRENCY vs. STERLING |

Q3 |

YTD |

12 MONTHS |

|

US Dollar |

-4.12% |

2.68% |

-4.81% |

|

Euro |

-0.04% |

7.32% |

2.34% |

|

Yen |

-2.03% |

5.72% |

-2.43% |

|

CURRENCY vs. US DOLLAR |

Q3 |

YTD |

12 MONTHS |

|

Rand |

4.26% |

4.54% |

7.51% |

|

Euro |

2.19% |

2.95% |

2.49% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.

Hope for a recovery underway

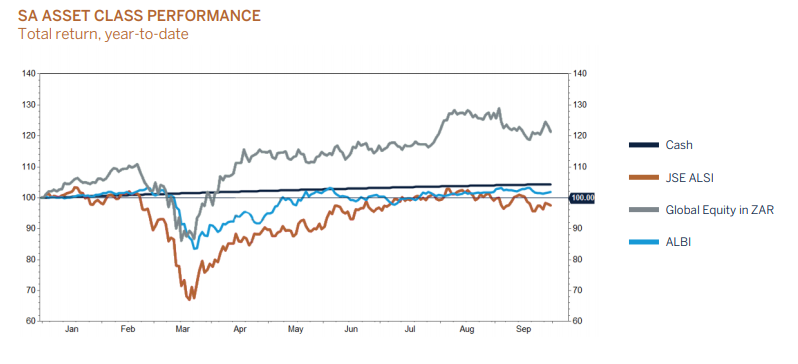

South African investment markets have been treading water since June and domestic equities are back into negative territory on a year-to-date basis after the correction in September. An increase in COVID-19 related cases and weak economic news flow in South Africa are largely to blame. Domestic- orientated stocks such as financials and retailers have borne the brunt of the pain of this year’s crisis, whereas precious metals, and the likes of Naspers and other rand hedge counters, have provided some support to the local bourse.

Offshore assets have performed strongly in Rand terms and provided much needed impetus to the performance of domestic portfolios – again illustrating the importance of regional and sectoral diversification. Regardless of the underlying value that exists, South African assets are expected to take their cue from global events such as the developments surrounding COVID-19, the US presidential elections and Brexit for the remainder of the year.

South Africa “awakens from the death”

South Africa has reached level 1 status of the government’s COVID-19 containment programme, which has allowed the economy to recover from a period of extreme pain in which more than 2 million people lost their jobs, while the full effects from the crisis will only be revealed in time. Although it will likely take the economy another two to three years to fully recover at least, the worst appears to be behind us as economic activity starts to gather pace again.

Low interest rates supported by low inflation will support the economy at the margin, but as SA Reserve Bank Governor Lesetja Kganyago indicated at the latest Monetary Policy Committee meeting, this won’t be enough to sustain growth in the long run. In the statement following the meeting, Governor Kganyago stated, “monetary policy however cannot on its own improve the potential growth rate of the economy or reduce fiscal risks. These should be addressed by implementing prudent macroeconomic policies and structural reforms that lower costs generally, and increase investment opportunities, potential growth and job creation. Such steps will enhance the effectiveness of monetary policy and its transmission to the broader economy.”

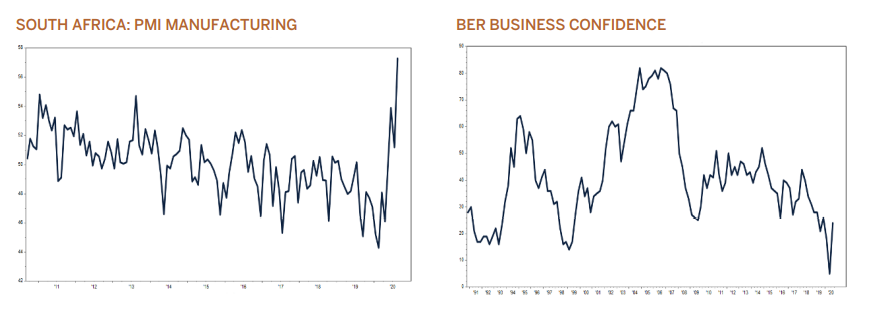

Leading economic indicators have changed direction and we expect that the manufacturing sector will recover first before the services sector starts contributing more meaningfully, in the same vein as the global trend. Pent up demand, low interest rates and inventory rebuilding will support manufacturing activity, while the services sector is expected to be hamstrung by a change in consumer behaviour and spending patterns. Tourism and leisure will continue to be affected by international travel restrictions.

On a separate and positive note, the corruption eradication drive, led by the National Prosecuting Authority, is starting to gain momentum. Several high-profile arrests have been made in recent weeks and more are sure to follow in the coming weeks ahead.

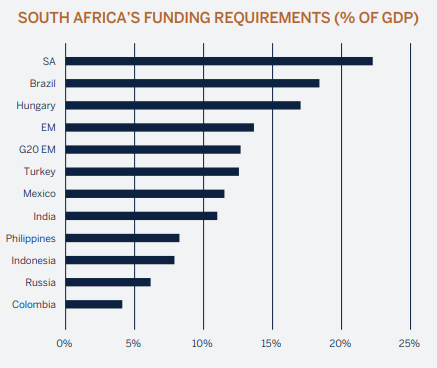

All eyes on the Medium-Term Budget Policy Statement

The Medium-Term Budget Policy Statement (MTBPS) in late October will be closely watched by investors and rating agencies as government is expected to provide more detail on its debt stabilisation programme and the initiatives in place to support its economic recovery plan. South Africa’s debt has spiralled out of control over the past few years, resulting in the country’s funding requirements growing and high interest charges which are among the worst on record. The latter point explains the significant increase in government’s cost of funding over the past few years. Spending on productive assets such as infrastructure, education and healthcare continues to play second fiddle.

Government’s recent R10.4bn bailout support for South African Airways does not make Finance Minister Mboweni’s job any easier when he presents the stringent fiscal parameters with which the country’s recovery will have to contend. Difficult decisions by government, such as strict austerity measures, will be required if it is serious about exiting the debt spiral that the country has fallen into. However, this has to be achieved while the economy finds its feet again.

In this respect, the ‘Economic and Recovery Action Plan’ derived from the social partners at the National Economic Development and Labour Council (NEDLAC) provides some hope that government, labour, community and business are finally looking to pull in the same direction to lift SA out of its costly debt trap. The agreed plan is imminently due for consideration and finalisation by Cabinet and is directed at building confidence and placing SA on a sustainable path of investment and growth.

The focus of the plan will be to rebuild the economy and effect structural reforms, which will enable sustainable and inclusive growth, with an intense focus on job creation. The Forum for Economic Recovery, an initiative chaired by President Cyril Ramaphosa, would have been instrumental in negotiating the agreement reached at NEDLAC. This year’s crisis would also have played an important part in aligning objectives and accelerating the formulation of the plan.

The plan will be infrastructure investment-led with a focus on introducing competition for Eskom and other state- owned enterprises, the awarding of broadband spectrum licences, simplifying regulation for mines, reducing red tape for small- to medium-sized businesses and to support localised manufacturing, to name a few.

It is encouraging to note that action plans and responsibilities have been identified for all social partners and that the plan aims to pragmatically balance short-term and long-term imperatives. Encouragingly, there was candid acknowledgement of the previous failures of implementation, which will be addressed by centralising planning and implementation in the Presidency.

Monthly meetings between the leaders from business, labour and civil society, with an aim to monitor and evaluate progress, will be convened to ensure that there is accountability for deliverables.

Although successful execution remains one of the largest inhibiters given that the plan still requires official endorsement by cabinet, investors should view this development as a positive step on the country’s road to recovery and is indeed a “historic milestone” as mentioned by the president at the most recent COVID-19 address. The COVID-19 crisis could be South Africa’s “never let a good crisis go to waste” moment.

Domestic Asset Allocation

|

Domestic Equity |

Neutral |

|

Domestic Cash |

Underweight |

|

Domestic Bonds |

Overweight |

|

Global Equities |

Neutral |

After a strong recovery from the lows in March, South African equity markets consolidated during the 3rd quarter. We have maintained our Neutral Exposure to Domestic Equities given the underlying value that the asset class presents. We are however cognisant that the value will only be unlocked once the outlook for growth improves on a more sustainable basis. Low interest rates will provide some support to the recovery of the domestic economy in the near term and a potential re-rating in valuations. Fiscal stimulus measures will remain constrained, however. Earnings are expected to trough this year and are expected to bounce back strongly next year from a very depressed base due to COVID-19. Without structural reforms and an improvement in business and consumer confidence, sustainable growth will remain a real challenge. One should also not expect that all companies will benefit from the cyclical recovery given how extreme the effects from the lockdown measures for many companies and sectors have been. We will continue to be selective in our approach and invest in businesses with strong balance sheets that have secular growth drivers and predictable outcomes.

The Overweight position in Fixed Income is unchanged from the previous quarter. South Africa’s debt metrics have deteriorated quite significantly over the past few years and the impact from the global pandemic has made it even worse. South Africa is stuck in a debt trap and only a significant pick-up in economic growth combined with fiscal discipline will improve government’s debt trajectory over the medium term - a difficult task which won’t be resolved overnight. Domestic bonds have factored in this reality, but any sell-off in global bonds (normalisation of yields) does pose a real risk to the country’s finances and in turn bonds valuations. We don’t expect such an event in the near term and with yields in excess of 9% against overnight interest rates of less than 3%, we find the asset class attractive at present.

The overweight position to domestic Fixed Income and Neutral exposure to domestic Equity leaves us with an underweight position to Cash.

We continue to find Global Fixed Income unattractive given how low (and in some cases negative) the starting yields are and maintain our underweight duration position to the asset class.

The weighting towards Global Equity has been maintained at Neutral. The global economic recovery is underway and even though we acknowledge that the asset class does not offer much value in the near term, we would expect it to outperform global cash and fixed income over the next 12 months.

Domestic Equity

|

Basic materials |

Underweight |

|

Financials |

Overweight |

|

Consumer Goods |

Overweight |

|

Consumer services |

Underweight |

|

Technology |

Underweight |

|

Telcos |

Underweight |

|

Industrials |

Overweight |

|

Healthcare |

Neutral |

SA Equity had a muted third quarter relative to the second quarter which had a bounce off the March 2020 lows. The Capped Swix delivered a return of 1.0% for the third quarter, bringing the year to date performance of SA equities measured by the Capped Swix to -9.8%.

The sector returns for the quarter were very mixed to say the least. Basic materials continued to perform strongly delivering a return of 6.0%, driven by Gold and Platinum stocks in the main which benefitted from the uncertain environment coupled with very low interest rates globally. Real Estate continued to struggle as the lockdown effects place pressure on rental income and valuations, falling 13.1% for the quarter.

Domestic equities continue to be subjected to volatility caused by local and global news. We started to see the economic damage caused by the lockdowns with very poor GDP numbers locally and globally. In addition, secondary wave effects of the COVID-19 pandemic continue to send fear through capital markets and caused sharp selloffs through the quarter. Markets also began to question fiscal stimulus packages and the momentum of the recovery globally.

Domestically, we witnessed GDP contract more than 50% in the second quarter (on an annualised basis). The government’s balance sheet continued to come under pressure as revenue collections dwindled and debt issuance increased. This means that fiscal spending is severely constrained, and we have little clarity on the government’s plans to stimulate the economy with the previously announced recovery package. We therefore believe that the South African recovery will lag the global recovery and as a result, the economy will take a few years to recover the already weak 2019 GDP base.

Against this backdrop, South African companies’ earnings will continue to be under pressure and a lack of investment from the private sector will further constrain the economy. This, however, is largely discounted in domestic equity share prices which look like good value, although realising the value may take some time.

During the quarter, many of the counters held by Melville Douglas reported or provided trading updates. As expected, the numbers were generally poor on an absolute basis but showed a level of resilience and a reasonable outlook relative to peers, as well as balance sheet strength which remains extremely important in this environment.

Melville Douglas remains focused on counters with very strong business models, balance sheets and free cash flow. These counters will have opportunities post the economic fallout and many of them are not reflecting their intrinsic value at this point. Now, more than ever, stock selection and diversification are paramount.

Domestic Fixed Income

The fiscal situation alongside weak growth remains a significant threat to the economy with the revenue collector having revised forecasted revenue collection down and expecting a revenue collection shortfall of more than R300 billion this financial year. Over the past decade, South Africa has added more debt, relative to GDP, than its emerging market peers. In 2009 South Africa’s debt was low, at less than 30% of GDP, a decade of debt accumulation has raised that number to 63.5% as of 2019/20, which is likely to become 81.8% this year, pushing South Africa well above the broad emerging market average of 63.1% according to the IMF. As a consequence of this debt accumulation and lingering concerns related to the funding of government’s debt, South Africa’s bond yield curve is one of the steepest in the world. Efforts were made to contain this debt growth, however these initiatives relied more on tax increases than spending cuts, with little contributions from reform initiatives. These high debt levels are likely to affect the recovery of the economy. A stretched balance sheet combined with a higher interest burden and the increasing risk of lower sovereign credit rating, will unfortunately not assist in rebuilding confidence and will remain a concern to foreign investors. Structural reforms are desperately required to put the country and its debt trajectory on a path of a sustainable recovery.

In the latest Monetary Policy Committee meeting in September, the bank gave its strongest signal yet that the interest rate cutting cycle may have bottomed when in a split vote, the committee voted to keep rates unchanged at 3.5% and signalled the possibility of higher interest rates next year.

South African bonds offer good long-term value and already reflect some of the funding concerns, but without an improvement in South Africa’s growth outlook and/or debt trajectory could remain cheap for an extended period. In terms of duration and yield curve positioning, we are neutral overall duration in the fund, and we prefer the belly of the curve (7 – 12 year area) and remain bearish on the long end for reasons mentioned above.

Conclusion

South Africa’s economy has been severely impacted by the global pandemic. The good news is that lockdown restrictions imposed by government have largely been lifted and this has allowed people to return to work and for some normalisation in economic activity. At the same time, interest rates have been cut to record low levels and government has injected significant fiscal support. However, the reality is that it will take some time before things return to normality.

South Africa’s economy was already in a difficult position in the pre-crisis era, after a prolonged period of weak growth. Corruption, unemployment and depressed confidence levels remain a concern and government’s debt levels won’t be resolved overnight, which all points to a prolonged recovery phase ahead of us. Domestic assets are already reflecting this new reality with many domestic shares trading at discounted valuations. Domestic bonds are also offering very attractive absolute and inflation adjusted real yields. Any improvement in the country’s growth outlook could unlock significant value for patient investors. It is therefore critical that President Ramaphosa’s growth initiatives take hold and the ‘Economic and Recovery Action Plan’ is implemented and that the country follows the “narrow road” – as suggested by Minister Mboweni.

At Melville Douglas, investment portfolios are not necessarily positioned for any specific macro-economic or political outcomes. We rather focus our efforts on investing in quality assets that we believe over the long term will deliver superior returns and ensure that portfolios are adequately diversified between different asset classes and geographies. This has protected our clients’ wealth in what has been one of the most volatile periods in history and will continue to do so in the future.

Domestic Market Performance %

as at September 2020

|

EQUITY |

SEPTEMBER |

Q3 |

12 MONTHS |

|

All Share Index |

-1.6% |

0.7% |

2.0% |

|

Capped SWIX Index |

-1.1% |

1.0% |

-5.0% |

|

Resources |

-3.4% |

6.0% |

27.3% |

|

Financials |

3.7% |

-0.7% |

-32.2% |

|

Industrials |

-1.5% |

-2.3% |

4.3% |

|

All Bond Index |

0.0% |

1.5% |

3.6% |

|

MSCI US |

-5.2% |

5.1% |

28.1% |

|

MSCI UK |

-6.5% |

-3.0% |

-5.6% |

|

MSCI Emerging |

-3.1% |

5.2% |

21.6% |

|

MSCI AC World |

-4.7% |

3.8% |

21.5% |

|

US DOLLAR RETURNS |

SEPTEMBER |

Q3 |

12 MONTHS |

|

MSCI US |

-3.8% |

-3.2% |

16.4% |

|

MSCI UK |

-5.1% |

1.0% |

-14.2% |

|

MSCI Japan |

1.0% |

6.9% |

6.9% |

|

MSCI Emerging |

1.0% |

9.6% |

10.5% |

|

MSCI AC World |

-3.2% |

8.1% |

10.4% |

|

Citigroup WGB Index |

-3.2% |

2.9% |

6.8% |

|

Currency vs. US dollar |

SEPTEMBER |

Q3 |

12 MONTHS |

|

Rand |

1.2% |

-3.4% |

-9.6% |

|

Euro |

-1.8% |

4.3% |

7.5% |

|

Yen |

0.4% |

2.4% |

2.5% |

|

Sterling |

-3.4% |

4.2% |

5.1% |