Quarterly Commentary: Q4 2020

View PDF versionThe end of a challenging year

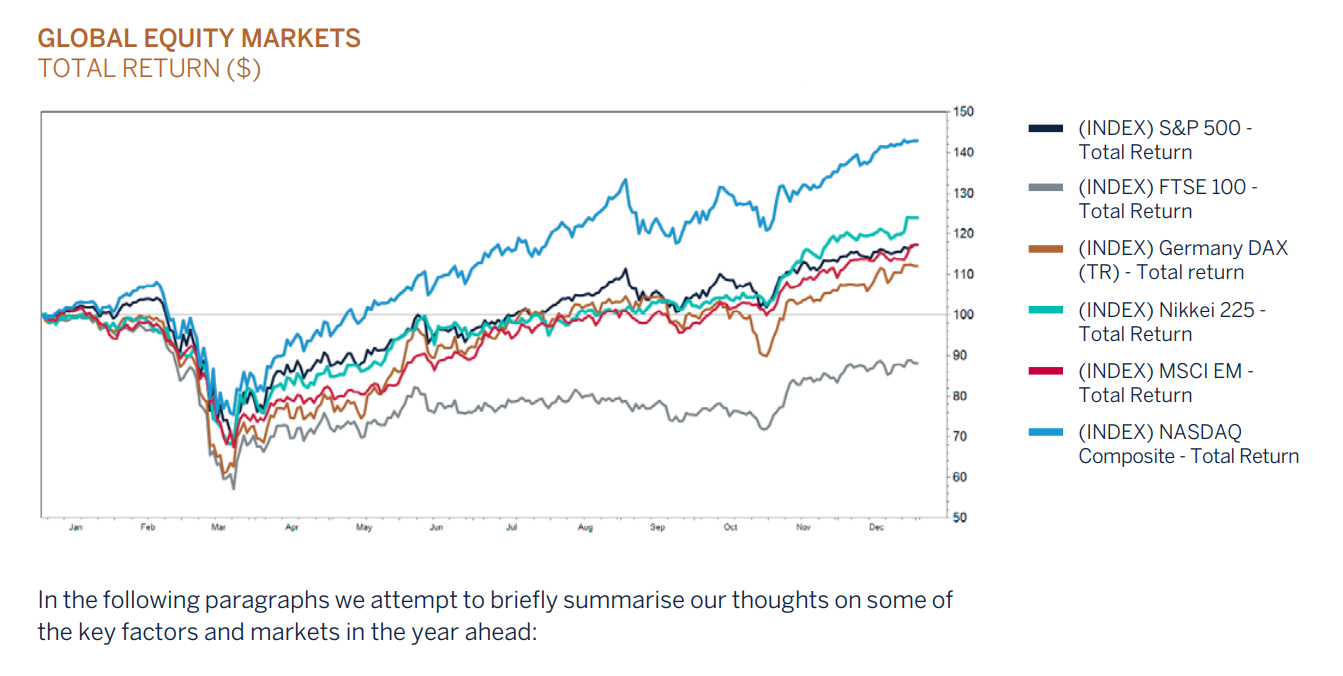

It is often said that ‘fact is stranger than fiction’ and indeed it is difficult to fully comprehend some of the events of 2020. The initial reaction to the pandemic, which has sadly claimed over 1.85 million lives so far, was for risk assets to drop sharply, with global equity markets falling some -35%, but the bear market proved to be the shortest in history and the ensuing global economic recession also proved to be extremely short-lived. We saw futures prices for oil contracts fall to an astonishing negative -$37.63 in April highlighting the extreme volatility and stress experienced in global assets in the earlier part of the year, which have since eased and allowed global equity markets to finish higher as a result of the truly colossal central bank and government monetary and fiscal stimulus together with hopes of a return to some sort of normality during the year ahead due to the roll out of effective vaccines.

The year also delivered a very divisive US election and a long-awaited Brexit deal, but for many 2020 will be considered a very challenging year that they might wish to forget. Attention now turns to what may unfold in 2021. As we remain in the middle of a global pandemic which continues to have the ability to materially change the direction of travel in each and every asset class, dealing with COVID-19 via a successful vaccination program clearly remains the determining factor for how 2021 will turn out both economically and socially. The simple truth is that we do not know exactly when this awful saga will run its course but we do know that it is transitory in nature and some of the best medical minds on the planet have worked tirelessly to get us closer to the light at the end of the tunnel with the development of vaccines that have surprisingly high efficacy rates.

Melville Douglas’ debates on market forecasting usually centre around global growth conditions, the generosity of central banks, interest rate forecasts and company earnings, and whilst all of these of course remain highly relevant, there is no doubt that these key factors remain hostage to the success of the worldwide vaccination program. We are optimistic on this front and as such increased risk during the final months of 2020 and are positioned overweight equity within client portfolios as we enter 2021. It would be remiss not to expect some road bumps along the way with regards to the implementation of successful vaccine distribution strategies, which hopefully will not only be deployed swiftly but also in the fairest way possible, not just to those with the deepest pockets. Maybe one positive side effect of this terrible episode will be that it brings nations, families and individuals closer together in a common humanitarian goal.

Source: FactSet

In the following paragraphs we attempt to briefly summarise our thoughts on some of the key factors and markets in the year ahead:

Global Economic Growth Outlook

We are likely to continue to experience an economic rollercoaster as the revolving door of COVID led lockdowns perseveres well into 2021. Much output has been lost and whilst it will be recouped in time, do not expect it to be immediate. Government and central bank support measures have been lifelines but nevertheless, the post[1]pandemic world will be one with many industries, businesses and individuals struggling. It is both expected and paramount therefore that stimulus measures and ultra-easy monetary conditions remain in situ for some-time to come; policymakers were too quick to enact tightening headwinds in the aftermath of the Global Financial Crisis and they are unlikely to make that mistake again. So ‘easy’ conditions look set to be with us for a while – at least until it becomes very clear economies can withstand diminishing stimulus - and that monetary and fiscal support will be an important tailwind for growth conditions in the quarters ahead whilst vaccines are being distributed. The side effect of this of course is worsening government deficits – but that is likely to be story for another year. Most economies experienced deep ‘services led’ recessions in 2020 as lockdown measures were enforced and whilst much of this lost output will not return, it is natural to assume that when they re-open (at or near full capacity) consumers, with pent up demand, will spend – in fact, we already have evidence of this with the robust economic activity evident in the third quarter of 2020. However, growth doesn’t have to be robust, indeed it wasn’t before the pandemic, it just needs to be travelling broadly in the right direction and at a pace strong enough to chip away at the economic wounds of COVID-19. Boom economic times may be reserved for the history books in favour of ‘new norm’ growth levels and without doubt hurdles remain (protectionism, de-globalisation, trade disputes etc.), but support measures remain overwhelming and therefore we are optimistic that global economic growth will once again prevail in 2021, although it is likely to be patchy and uneven as many industries and economies will remain suppressed due to ongoing COVID disruptions.

World Economic Outlook

| PROJECTIONS | DIFFERENCE FROM JUNE 2020 WEO UPDATE | DIFFERENCE FROM APRIL 2020 WEO | |||||

|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | |

| WORLD OUTPUT | 2.4 | -4.7 | 4.8 | 1.4 | -0.5 | -0.5 | -0.6 |

| aDVANCED ECONOMIES | 1.7 | -5.8 | 3.8 | 2.3 | -1.0 | 0.4 | -0.7 |

| eMERGING MARKET AND DEVEOLPING ECONOMIES | 3.6 | -3.0 | 6.2 | -.1 | 0.1 | -1.7 | -0.6 |

| Emerging and Developing Asia | 5.7 | -0.7 | 8.0 | -0.4 | 0.4 | -1.7 | -0.6 |

| Emerging and Developing Europe | 2.1 | -4.5 | 3.8 | 1.3 | -0.5 | 0.7 | -0.3 |

| Latin America and the Caribbean | -0.5 | -8.1 | 3.6 | 1.3 | -0.1 | -2.8 | 0.2 |

| Middle East and Central Asia | 1.0 | -5.7 | 3.2 | 0.3 | -0.4 | -2.1 | -1.1 |

| Sub-Saharan Africa | 2.8 | -3.5 | 3.1 | 0.2 | -0.3 | -1.5 | -0.9 |

| Memorandum | |||||||

| Low-Income Developing Countries | 5.1 | -1.4 | 4.7 | -0.1 | -0.3 | -1.6 | -0.7 |

Source: IMF staff estimates. Note: The aggregate growth rates are calculated as a weighted average, where a moving average of nominal GDP in US dollars for the preceding three years is used as the weight, WEO = World economic Outlook. 1 Difference based on rounded figures for the current, June 2020 WEO Update, and April 2020 WEO forecasts.

Bond Markets

When assessing bond markets, it is important to make the distinction between government (safest) and corporate/ high yield (riskier). As their opposing risk characteristics suggest, one should be cheap, the other shouldn’t, but in the current abnormal environment that isn’t the case – they both appear expensive. The reason for this is fairly simple; risk free interest rates are as good as zero or indeed increasingly turning negative and if central banks keeps manipulating yields lower surely that’s an almost riskless trade investors want to be part of? Well, the answer was a firm yes in 2020 but looking forward we have our reservations concerning the sustainability of both government yields and corporate credit spreads to remain at such low and outright expensive levels. It would be fair to say we are more concerned with the very low level of perceived safe-haven government yields than we are with narrow corporate spreads, although even the latter now seems somewhat out of sync with economic reality. Central banks have become the biggest buyers of their own bonds, by far, thanks to quantitative easing and this has been a key factor in driving yields to abnormally low levels. The result is that we now have many bond markets trading as pure ‘capital’ plays with little, and quite often negative, yield protection. Consequently, the smallest move in yields can equate to large capital swings and the danger here is that it has (almost) been a one-way street in recent years and the onset of the pandemic has only served to drive yields even lower. Sure, in a low growth and inflation environment this can continue for a while longer yet, but if either surprise on the upside there could be a rush for the exit door. Investment grade and high yield corporate debt is perhaps a little easier to understand as the ongoing global ‘search for yield’ has found itself with increasingly fewer places to look and these markets tap into that desire. However, participation in crowded trades can often blind investors to the fundamentals and therefore one should never forget to ask ‘am I being paid for the risk?’. We don’t believe corporate bond markets are yet pushing the risk/return boundaries but there is no doubt that the asset class is on the expensive side and as such dissuading us from aggressively adding to current weightings.

Brexit – Historic Trade Agreement Signed

Since the United Kingdom (UK) formally left the European Union (EU) on 31 January 2020, investors have long been focused on the state of negotiations over a new trading arrangement to follow the transition period that ended on 31 December 2020. Typically, and with just a week left the parties finally agreed a deal which has been politically ‘spun’ to impose the impression of a ‘win-win’ situation for both sides.

The final major sticking point in the agreement was EU fishing boat access to UK waters given the political sensitivities for the UK and EU coastal states including France, Belgium and the Netherlands. However, economic pragmatism has won the day with the fishing industry valued at $730m, or less than 1% of annual trade between the nations. It seems without full disclosure (yet) that a transition period stretching to five years along with an agreed EU catch reduction has been enough to achieve acceptance. The other tough issue that has been overcome was the EU demanding that the UK ensures fair competition in future by not slashing its state-aid, labour or environmental rules, but the finer points on this and how to ‘police’ such issues is included somewhere within the full 2000 plus page trade document! However, in some quarters there will be disappointment that there is nothing in the agreement about UK financial services which remains to be agreed and is hugely important to the UK economy and its future.

Undoubtedly, a trade agreement is very good news for the broad world economy. It comes at a time when new strains of the Covid-19 virus may impact the effectiveness of worldwide mass vaccinations later this year along with the prospective 2021 global economic recovery. It is a key comfort for those businesses that contribute to the annual $900bn EU/UK trade as well as satisfying Joe Biden, the incoming US President, who is looking to his European allies to increase political cooperation in his quest to deal more effectively with perceived Chinese ‘threats’.

Financial markets have proved an accurate discounter of events as shown by the recent recovery in Sterling against the US dollar and to a lesser extent that of the Euro. Quite noticeably, the UK stock market has been a weak relative performer against other major bourses as overseas investors have shied away from UK exposure given the underlying difficulties that will arise as a result of a post Brexit economy. Nonetheless, with an agreement now signed, it may signal a moderate resurgence of overseas interest in the UK and Sterling which could provide some economic crumbs of comfort for Boris Johnson and his government. Domestically, UK companies will breathe a big sigh of relief that they can continue to trade with ‘zero-tariff’, ‘zero quota’ access to EU markets. The supply chains appear now to be safe so that business can conduct activities without the hindrance or inertia that Brexit has produced. Domestically orientated companies have recently fared well in share price terms with UK Banks, some Retail and Housebuilders all capturing extra investor attention. Elsewhere, our preferred multi-national companies have proved quiet given the dampening translation impact of a recovering pound, though historically these periods have proved short lived.

US Election

After a turbulent post-election period of legal challenges to the results by Trump and his allies, despite losing the electoral college by the same margin as Hillary Clinton in 2016, and the popular vote by almost 8 million votes, the duties of the electoral college and US congress are almost at an end with the final constitutional event taking place on 6 January, where the results of the voting process will be sent to Washington DC and formally counted in a joint session of Congress, presided over by Vice-President Mike Pence.

The backdrop to all the unnecessary excitement is the two Georgia Senate ‘runoffs’ on 5 January 2021, which will ultimately decide control of the Senate. Whether we have Mitch McConnell (Republican) or Chuck Schumer (Democrat) as senate leader will significantly influence Biden’s success or lack thereof in his first two years in office. If the Republicans hold on to the Senate, expect more gridlock and challenges to the Biden agenda, and a preference for the status-quo.

In Biden’s latest speech, he said it’s “time to turn the page” after his election victory was confirmed. A clear affirmation that despite the domestic political turmoil and divisions inside the US, Biden is first and foremost a pragmatist. After 48 years in government, since he was first elected to the US Senate for the state of Delaware, his campaign and administration will expectedly focus on themes of unification, bipartisanship and his ability to collaborate with moderate Republicans; moderates form most of the Republican representation in the Senate. Biden is expected to focus on key legislation, such as infrastructure, environment, green energy, and improvements to the Affordable Healthcare Act (Obamacare).

What we as investors will concentrate our minds upon is the Biden initiative to rejoin the Paris Climate Agreement, thus committing to cut US greenhouse gases by up to 25% by 2025. This is highly positive for investment and companies embracing environmental, social and governance initiatives so our Melville Douglas philosophy of allocating only to companies that can display strong corporate and social disciplines look well positioned. Additionally, appointing Pete Buttigieg to transport secretary is a clear indication of the want for a sweeping infrastructure bill that will increase the potential for cyclical companies to progress as the 2021 economic recovery takes hold. Biden’s values of multilateralism and engagement on the world’s stage has not changed so a reversal of Trump’s isolationist view is very much on the cards. Reaching out to NATO allies to repair divisions will allow the formation of international coalitions centered around democracy to fight China’s trade practices, instead of the current combative unilateral trade tariffs. One should also not disregard the enthusiasm that the new President will bring to healthcare and cancer research given that Biden’s son Bo died of cancer in 2015.

Finally, many of us have grown accustomed to hearing the President’s thoughts and feelings broadcast to his 60 million Twitter followers; an insight into a President’s mind we have not previously been privileged to. Biden’s decisions will be behind closed doors for the most part. On a positive note – we no longer need worry about Presidential ‘tweets’ that can alarmingly move financial markets on a whim!

Conclusion

The discovery of vaccines with very high efficacy rates in such a short period has brought hope as widespread vaccination programs are expected to break the link between mobility measures and the number of infections. Risks in the near term remain, such as the supply and usage rates of the vaccines, whilst new strains of the virus are a concern, but there is no doubt that the recent breakthrough in medical technology has improved the medium-term outlook significantly. In addition a combination of other factors such as pent up demand, high savings ratios, inventory rebuilding and policy support in the form of low interest rates and fiscal initiatives, which include income payment transfers and infrastructure projects, and perhaps a more predictable geo-political environment (think outcome of US elections and Brexit trade deal) will all contribute to an improved growth outlook for 2021 and beyond.

Investors should however remain selective and vigilant in their approach given elevated debt levels and less favourable valuations. We will continue to invest in quality securities with strong balance sheets, proven business models and secular growth drivers which will ultimately result in sustainable and predictable uplifts in profitability.

Investment Performance

The announcement of multiple vaccines with efficacy rates higher than forecast coupled with Joe Biden’s US Presidential election victory led to a strong equity market rally during the final quarter of the year. Whilst our client portfolios participated in the rally, aided by the decision to move from marginally underweight to marginally overweight equites due to the positive vaccine data, relative performance lagged due to the considerable market rotation away from large cap growth companies in favour of value-style and more cyclical sectors. However, given the strong outperformance in the previous nine months global USD and GBP multi-asset portfolios generally ended 2020 favourably on an absolute basis and reasonably inline on a relative basis. The UK FTSE All-share TR index fell -9.8% for the year, its worst showing since the 2008 financial crisis. Domestic GBP portfolios struggled throughout 2020 on both a relative and absolute basis although with a trade agreement now signed between the EU and UK, we are hopeful of a recovery in UK companies in the year ahead as they breathe a big sigh of relief that they can continue to trade with ‘zero-tariff’. On a year-to-date basis, US Dollar and Sterling Fixed Income mandates have delivered positive returns ahead of cash. However, performance has lagged our internal benchmarks due to our ongoing cautious short duration strategy as risk/return metrics continue to appear very unfavourable.

Asset Classes

|

Equities |

Overweight |

|

Fixed Income |

Underweight |

|

Cash Plus |

Overweight |

Asset Allocation

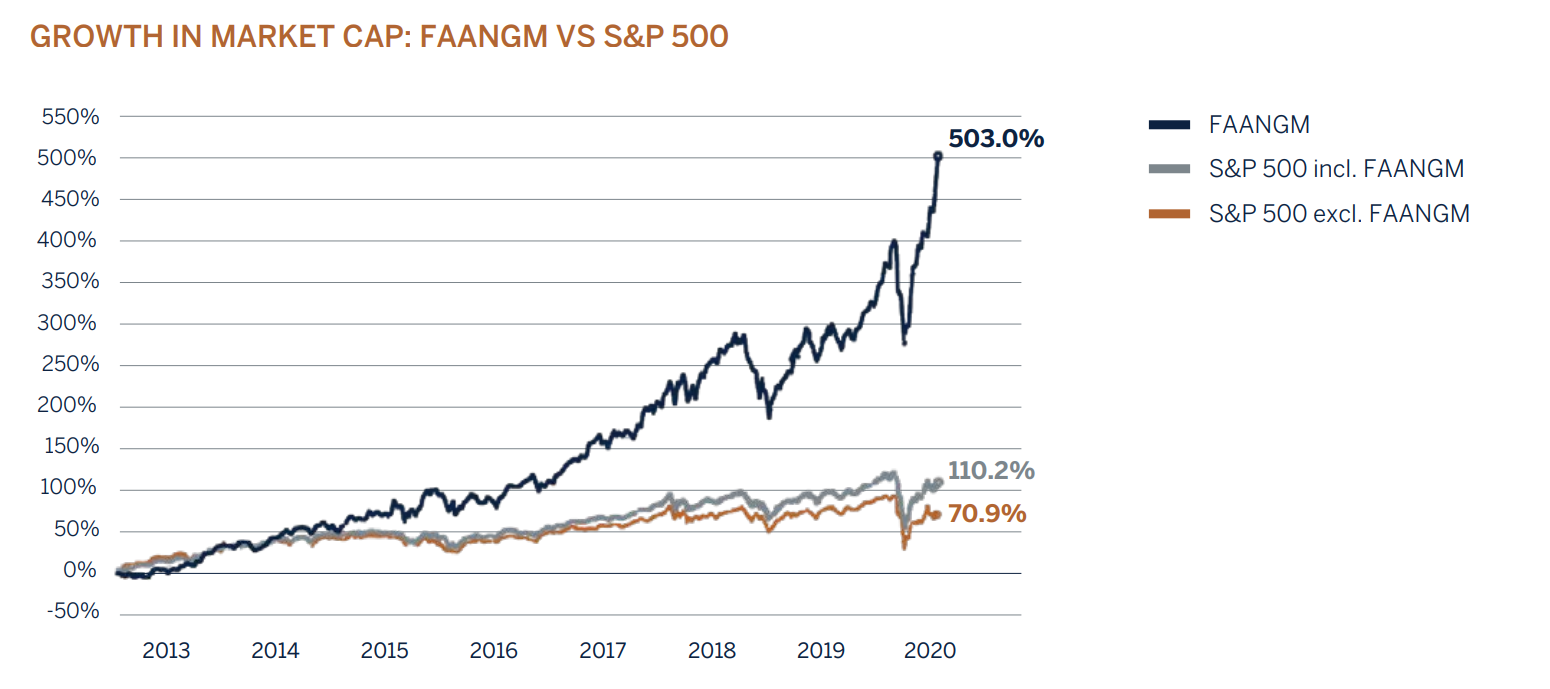

We have been adding to risk assets such as global equities at a measured pace following news of the development of successful high efficacy vaccines. We acknowledge that valuations are not cheap by historical standards but would expect an improvement in the outlook for corporate earnings to continue to support returns in the year ahead. The earnings recovery cycle (pre-crisis levels) for the MSCI All Country World Index is expected to be completed towards the end of 2021, implying 25% growth in earnings per share over the next 12 months. Furthermore, many companies will reinstate the payment of dividends after one of the most challenging years in history which will provide an additional underpin for patient investors. Equity returns have been very concentrated during 2020 and outside of the US, China and a handful of mega large information technology and other growth shares, returns have been disappointing, especially for those companies that have been severely affected by the pandemic. Going forward we expect the dispersion of returns from equities to broaden as the global economic recovery becomes more widespread with the support from policy makers. We will continue to invest in companies with strong balance sheets and secular growth drivers which will ultimately result in sustainable and predictable growth in profitability.

Long dated government bonds stand to lose the most from a sustained global economic recovery and as such we remain underweight fixed income securities. We do not expect interest rates to be raised anytime soon but do believe that significant downside risks persist for holders of longer dated government bonds. Two thirds of all developed market government bonds are yielding negative yield-to-maturities, meaning that investors are guaranteed of earning negative returns if these bonds are held to maturity. In the US, unlike Europe and Japan, long dated (10 year) bonds are at least trading at positive income yields, but these yields are still well below long term inflation expectations. Not only are the starting yields unattractive, duration risk (capital risk) has also become extreme with a 1% upward parallel shift in the yield curve resulting in capital losses in excess of 8% for many long dated developed market bonds.

We have been selectively and opportunistically increasing exposure to investment and non-investment grade dated bonds. This has and will continue to bolster returns, but at current spreads we are not looking to add aggressively to credit. Although our positioning favours short dated bonds, we have been taking advantage of the modest sell[1]off in government bonds towards the end of 2020 which has resulted in the steepening of the yield curve, to extend duration.

Cash weightings have been reduced and remain tactical in nature, ready to be deployed as further investment opportunities arise.

Equities

|

Consumer Discretionary |

Overweight |

|

Consumer Staples |

Neutral |

|

Energy |

Underweight |

|

Financials |

Neutral |

|

Healthcare |

Overweight |

|

Industrials |

Neutral |

|

Information Technology |

Overweight |

|

Materials |

Neutral |

|

Consumer services |

Neutral |

|

Utilities |

Neutral |

|

Real Estate |

Underweight |

The sheer pace and magnitude of the recovery in most global equity indices from the March lows has surprised. However, as alluded to in previous updates, the rally has been far from broad-based with ‘stay at home’ and ‘growth’ stocks leading the rebound ahead of their more cyclical and value counterparts. Given the COVID led changes in consumer behaviour and the search for stable and repeatable earnings growth under a low interest rate environment this trend is understood and may have further to run but the relative performance gap is extreme and could close if vaccines are administered swiftly and successfully thereby allowing economies to re-open and mobility to again return. With cash and sovereign bonds looking set to continue to offer only negative real (after inflation) returns for some time to come quality global equites remain a preferred asset class. However, there is no escaping the simple fact that equity markets have rallied strongly and at current prices they should not be viewed as being cheap; many share prices are anticipating better times ahead and therefore without meaningful improvements in the permanent containment of COVID in the coming 3-6 months then equity prices could be set for some short term volatility. Having said this there is no escaping the predominantly risk-friendly backdrop. Namely, central banks are going to keep their feet on the stimulus pedals (both fiscal and monetary), economies should begin to open up and should be met with strong pent-up consumer demand and the general direction of travel for economic data should be positive, albeit from low bases. Ultimately, a favourable climate for risk assets that sadly will not stop some two-way volatility, but should ensure that downside periods are not lasting, rather viewed as buying opportunities – we remain cautiously optimistic.

Source: Yardeni Research

Fixed Income

|

G7 Government |

Underweight |

|

Index-Linked (US Government) |

Overweight |

|

Investment Grade - Supranational |

Overweight |

|

Investment Grade - Corporate |

Overweight |

|

High Yield |

Overweight |

Longer-dated US government bond yields have been steadily rising since early August but relative to the outlook for a sustained recovery in economic growth conditions next year and for inflation to trend higher, we believe the market remains expensive, particularly based on historic ‘real return’ levels. It appears likely that the 10-year benchmark will breach 1% but we are mindful that the Federal Reserve will only tolerate yields rising sharply if coupled with signs that the economy is on a sustainable path to pre-pandemic levels. If not, further manipulation of the yield curve via quantitative easing measures (i.e. buying longer dated US treasuries) is probable. With interest rates near zero and destined to stay there for some time, the yield curve has steepened in recent months but the difference between two- and ten-year issues still remains some 50 basis points below its ten year average and therefore, not yet close to levels that we would deem sufficiently attractive to consider extending durations. Ultimately, market yields remain extremely low which in turn raises the duration risk exponentially and this is not a favourable mix for longer[1]dated bonds when taking a medium to long-term view – we remain cautiously defensive.

UK sovereign bond yields fell sharply throughout 2020 with all Gilts maturing in six years or less now trading on negative yields. The continued ‘will they, won’t they’ delays on a final Brexit deal together with the spread of a new “mutated” coronavirus strain understandably led to demand for safe[1]haven government bonds. The market is pricing in a bleak picture for the UK economy, suggesting rates will remain lower for longer, something we fully subscribe to. However, whilst UK PLC has clear headwinds, after a circa 11% contraction in 2020 we expect the economy to expand in the year ahead although the timing and pace will be at the mercy of the pandemic and, more importantly, the vaccine deployment. With yields either negative or close to historic lows, our defensive ‘underweight duration’ bias remains – the yield advantage on longer-dated bonds is negligible and vastly outweighed by potential capital downside risk. We expect a more attractive buying opportunity, although this may not present itself until the second half of the year.

Our strategies have retained a moderately overweight allocation to investment grade and high yield corporate credit. However, we are cognisant that these markets have rallied strongly since late March to the extent that spreads on both are now either at or close to pre-pandemic levels. The level of forward-looking optimism, aided by an ongoing search for yield and central bank support justifies these moves. Whilst we do anticipate ongoing demand for these higher yielding markets, further significant upside may be limited from current levels if markets begin to price in diminishing central bank support via quantitative easing. As with all ‘risk’ markets the direction of travel will not be ‘one way’ and whilst we are happy to maintain our current allocations, we will aim to increase at more attractive levels.

Currencies / Interest Rates

RECOMMENDATION - INTEREST RATES

|

Current |

Direction |

||

|

US Dollar |

Overweight |

0.25% |

→ |

|

Sterling |

Neutral |

0.10% |

→ |

|

Euro |

Underweight |

0.00% |

→ |

The US Dollar weakened in the second half of the year, more than we had anticipated and to the detriment of our overweight strategy. In particular, the currency’s slide against the Euro during this period has been meaningful however it should be noted that the US government bond market has significantly outperformed its German counterpart year-to-date so the relative cost to performance has not been material. Looking ahead, further downside in the US Dollar is very much the ‘consensus’ opinion which, in itself should be a slight concern, particularly given the weakness already experienced this year. Ultimately, we may be forced to reduce the long held overweight strategy but we remain very mindful that the US bond market still enjoys a considerable yield pick-up over virtually all counterparts (circa 1.5% in the case of German ten-year bonds for example) and therefore, allocating to Euro or Yen assets forces our strategies to invest in zero, and more often deeply negative yielding assets.

Sterling had a strong run into year-end thanks to a mix of broad US dollar weakness and positive news on the Brexit trade deal. At current levels it appears much of the good news may be priced-in but we are not discounting further short-terms gains. Years of wrangling over Brexit and the COVID-19 pandemic have taken their toll on the UK economy and whilst we are more optimistic for the year ahead, there is a big mountain to climb to recoup much of the lost output. Interest rates are certainly staying put and, though this is not our base case, speculation remains that the Bank of England may consider taking them negative. Our Sterling International strategies have remained moderately overweight base currency and we will continue with this strategy unless it becomes apparent that the currency has run ahead of economic fundamentals.

Market Performance % / as at 31 December 2020

|

EQUITIES |

DECEMBER |

Q4 |

2020 |

|

Global |

|||

|

FTSE All World TR Net (Sterling) |

2.20% |

8.44% |

12.43% |

|

FTSE All World TR Net (US Dollar) |

4.64% |

14.66% |

16.01% |

|

UK |

|||

|

FTSE All-Share TR |

3.86% |

12.62% |

-9.82% |

|

US |

|||

|

S&P 500 TR |

3.84% |

12.15% |

18.40% |

|

Europe |

|||

|

Dow Jones Euro STOXX TR |

2.09% |

12.57% |

0.25% |

|

FIXED INCOME |

DECEMBER |

Q4 |

2020 |

|

Bloomberg Barclays Series - E UK Govt 1-10 Yr Bond Index |

0.53% |

0.16% |

3.17% |

|

Bloomberg Barclays Series - E US Govt 1-10 Yr Bond Index |

0.03% |

-0.23% |

5.49% |

|

JP Morgan Global Government Bond (Sterling) |

1.17% |

-3.29% |

6.29% |

|

JP Morgan Global Government Bond (US Dollar) |

1.19% |

2.26% |

9.68% |

|

Iboxx Sterling Corporates Total Return Index |

1.68% |

3.96% |

8.63% |

|

Iboxx US Dollar Corporates Total Return Index |

0.47% |

2.89% |

9.62% |

|

CURRENCY vs. STERLING |

DECEMBER |

Q4 |

2020 |

|

US Dollar |

-2.20% |

2.68% |

-2.84% |

|

Euro |

-0.03% |

7.32% |

5.78% |

|

Yen |

-1.25% |

-3.39% |

2.15% |

|

CURRENCY vs. US DOLLAR |

DECEMBER |

Q4 |

2020 |

|

Rand |

2.27% |

4.29% |

8.87% |

|

Euro |

0.97% |

2.15% |

5.13% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.