Quarterly Commentary: Q4 2024

View PDF versionSteady momentum across global financial markets

As we enter 2026, from all at Melville Douglas we wish to extend our very best wishes to you and your families for a healthy, fulfilling, and prosperous 2026.

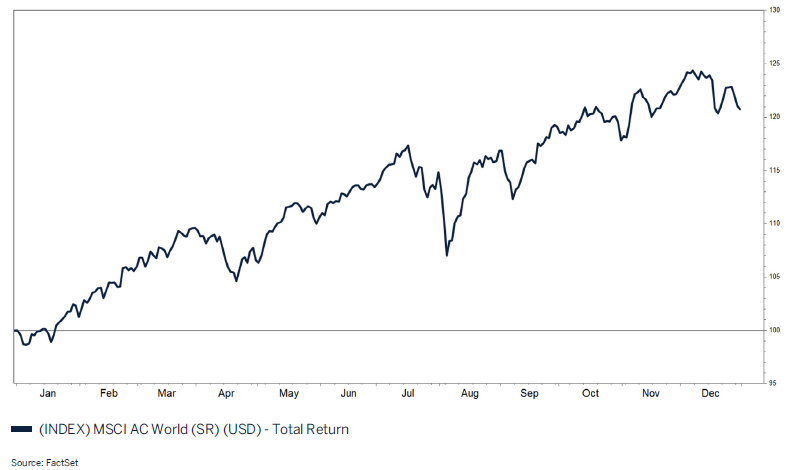

2025 will be remembered as a period defined by resilience, reinvention, and broad‑based strength across global markets. What stood out most was not the absence of uncertainty, but rather the market’s ability to absorb it. Despite political shifts, heightened geopolitical tensions, advances in artificial intelligence (AI), and meaningful policy pivots, portfolios were rewarded favourably on both an absolute and inflation adjusted basis.

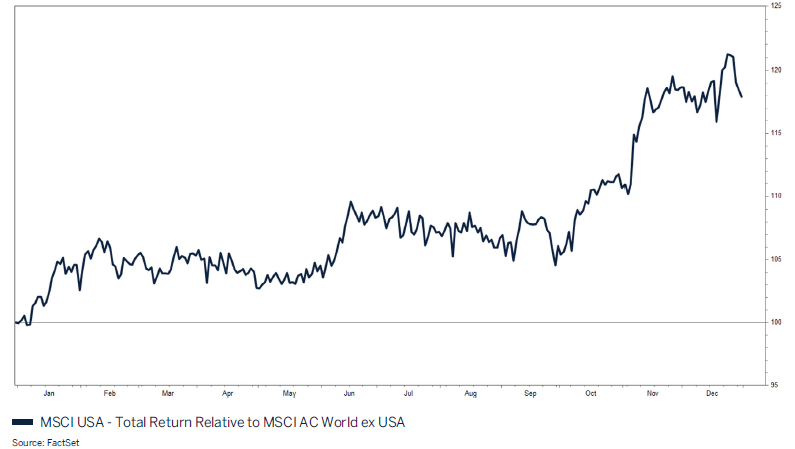

Donald Trump’s recent US Presidential victory has significantly contributed to the outperformance of US assets relative to the rest of the world

The impressive performance of the US economy has played a pivotal role in this upward trend. Robust job growth, rising wages, and resilient consumer confidence supported by the positive wealth effect have underpinned economic stability and expansion. This has not only bolstered domestic US markets but also had a ripple effect globally, enhancing investor sentiment and market performance worldwide. Consequently, the combination of these elements has created a fertile environment for equity markets, driving them to new highs and reflecting the strengthened economic fundamentals and optimistic prospects for businesses around the globe for the year ahead.

Adding to this momentum, Donald Trump’s recent US Presidential victory has significantly contributed to the outperformance of US assets relative to the rest of the world. His policies of lower taxes, fiscal expansion, import tariffs, reduced regulation, and a softer stance towards Environmental, Social and Governance (ESG) integration are aimed at boosting the economy as well as business and consumer confidence. With a clean sweep across the House of Representatives and the Senate, it is viewed that Trump will have the necessary support from Congress to implement many of his stated policies. This political backing is expected to further stimulate economic growth, enhance corporate profitability, and sustain the positive trajectory of the equity markets.

Make America Great Again – 2.0

While 2024 will be remembered as the year of elections, with more than 100 countries accounting for nearly half of the global population voting, the outcome of the US election was perhaps the most closely followed by market participants due to the sheer size of the country’s economy and the US market’s dominance in global financial markets. Biden’s unexpected and late exit from the presidential race opened the door for Trump and the Republican party to secure a convincing victory over the Democrats. Trump’s policies are expected to benefit US corporations and taxpayers at the expense of their trading partners. However, the enforcement of import tariffs on global goods and restrictions on immigration could result in unintended consequences such as stickier or even an unwanted lift in inflation, significantly higher government debt, a slowdown in capital formation by the private sector, a deterioration in global trade, and supply disruptions of goods and services.

It is important for investors not to overreact to the potential outcomes of Trump’s stated policies, as the actual results are highly likely to differ significantly or be more moderate than what was communicated during the election period. Trump is an astute negotiator and is known for his transactional approach.