Signs of optimism as inflation trends lower and growth surprises

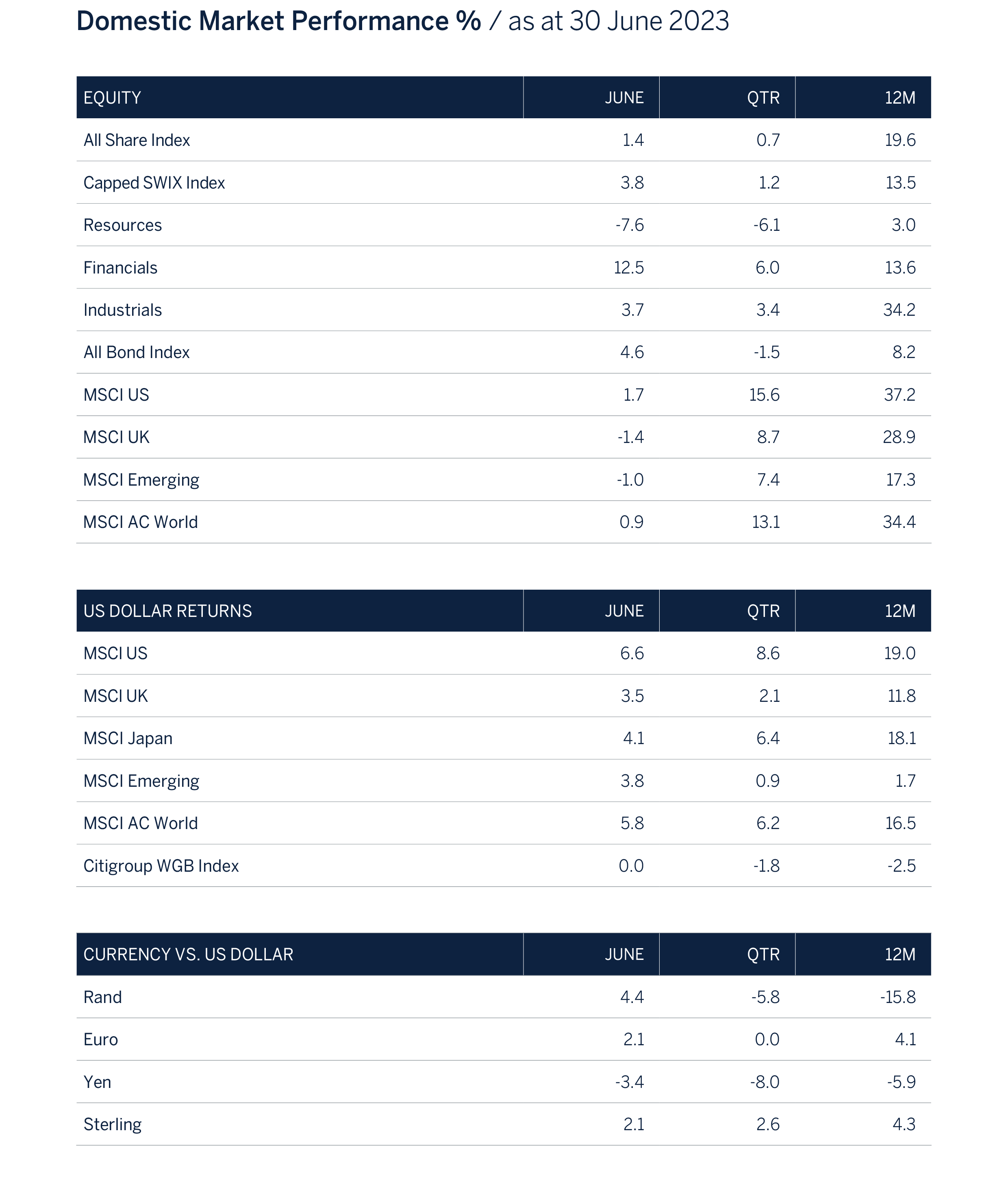

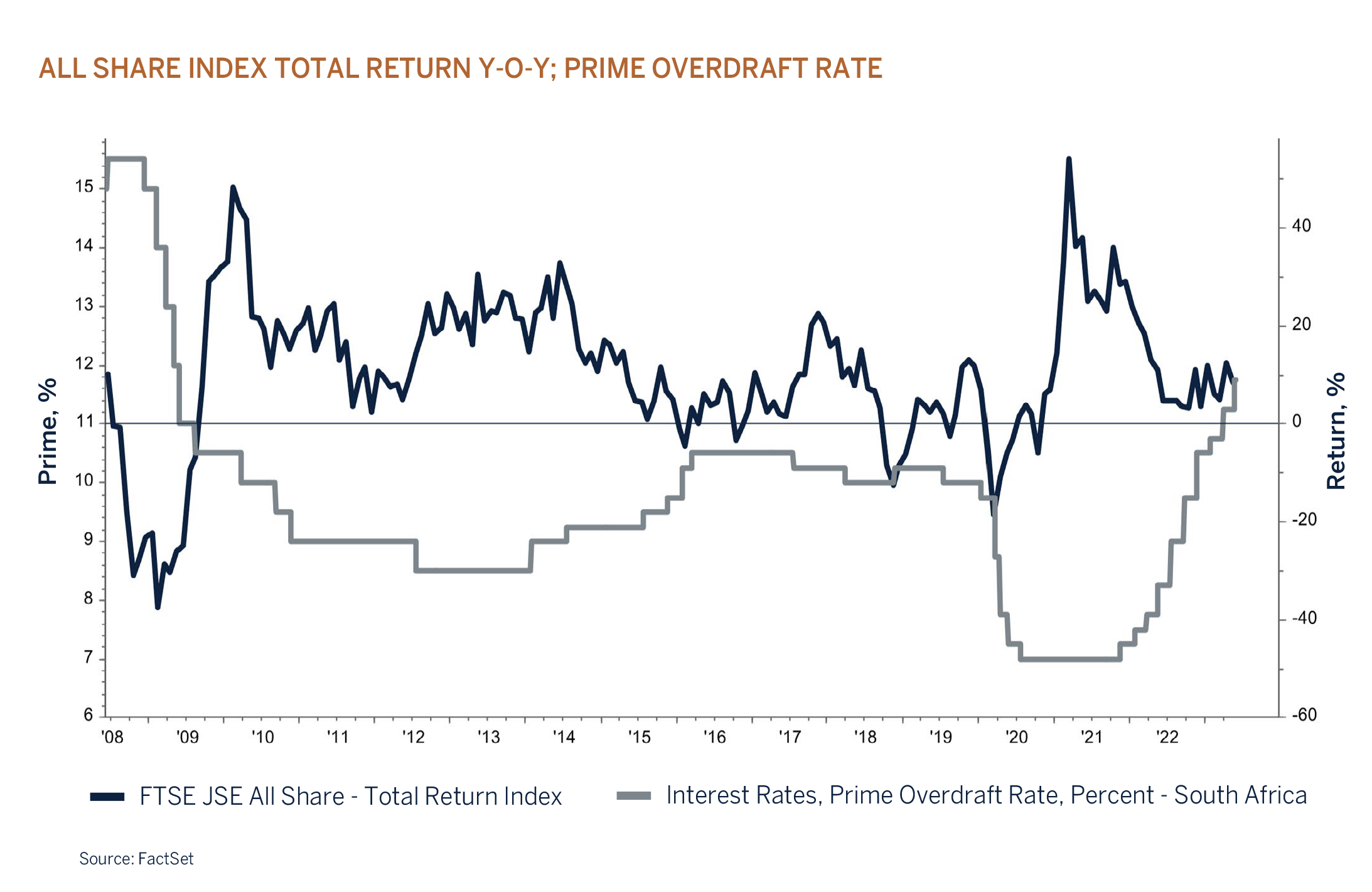

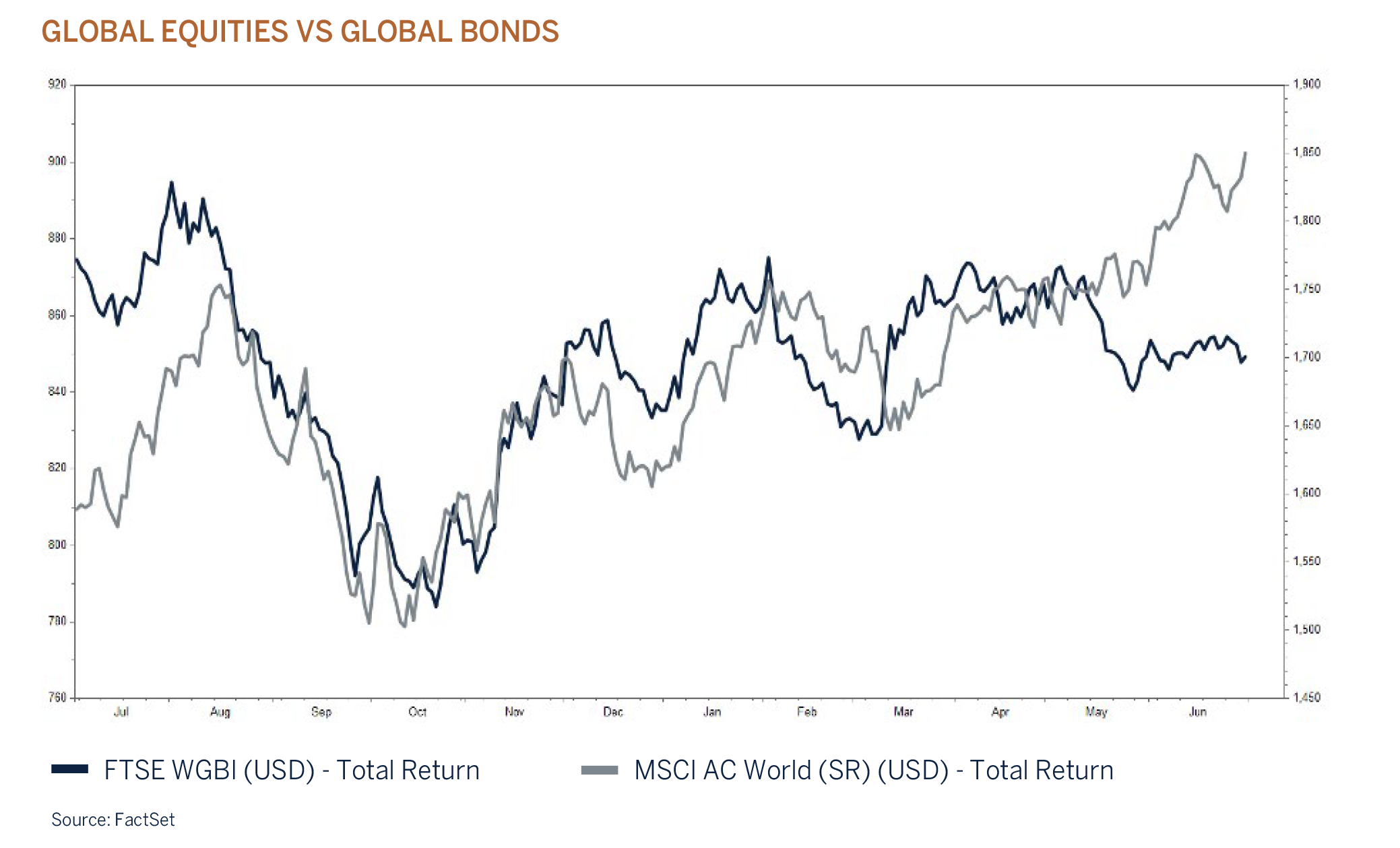

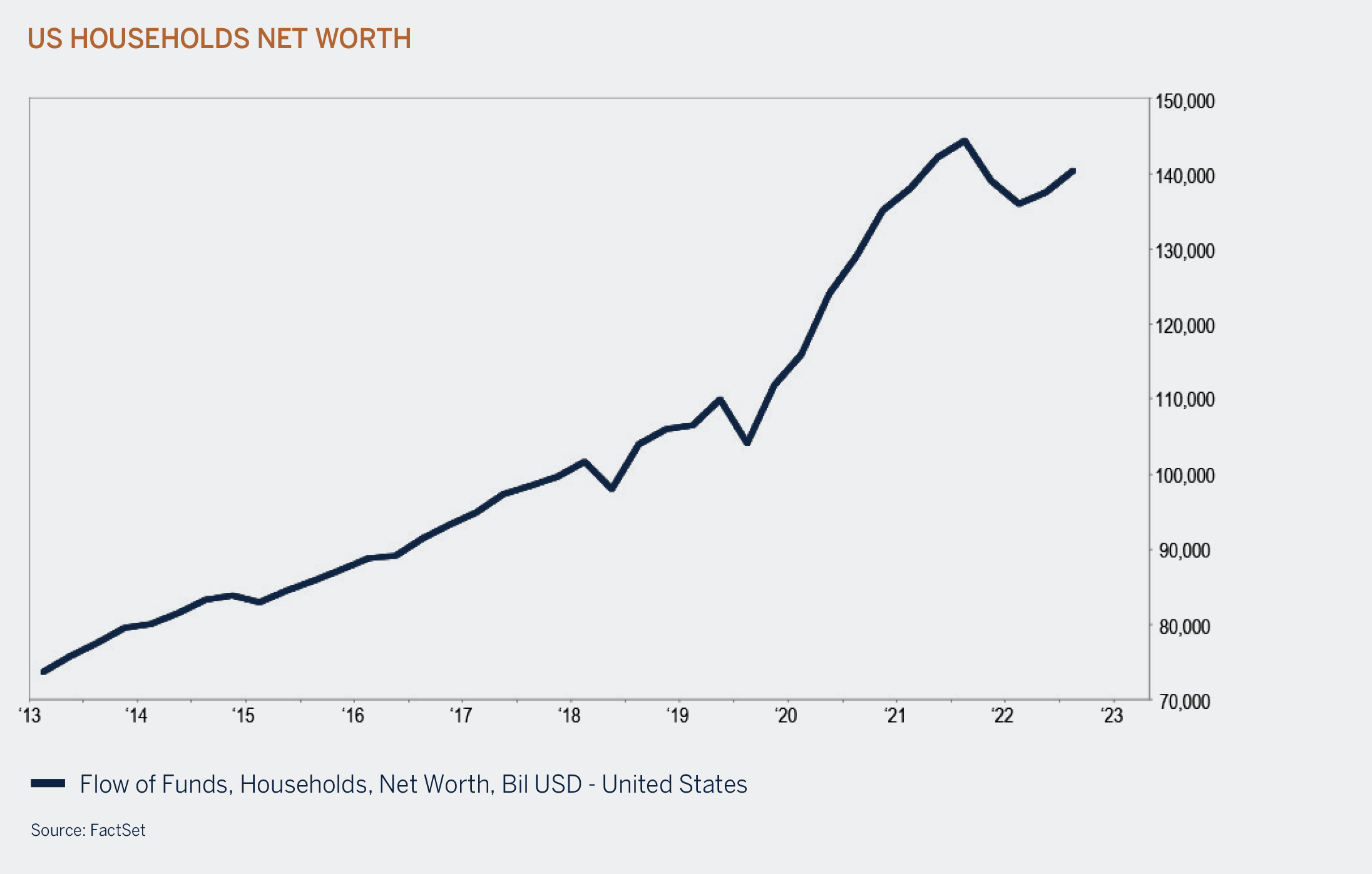

Global equity markets have not disappointed this year. At the end of June, the MSCI ACWI had returned +14% in US dollar terms and is now up a little over 25% since the market bottomed in October last year. Slightly surprising, given that interest rates have not yet peaked, and central banks have once again turned more hawkish in their guidance in a concerted effort to bring inflation under control. At the same time, the outlook for the global economy and corporate profits remains lacklustre, after a period of stronger than expected growth. Offsetting these concerns is the disinflationary trend that is in place. Headline inflation has fallen sharply in most economies as energy, metal and soft commodity prices are significantly lower than a year ago, but core inflation has remained stickier, given ongoing strong employment markets that have driven wages higher, supporting services-driven economies and the housing/rental market. Lower inflation, if sustained, does however provide a glimmer of hope that the end of the monetary tightening cycle is in sight and that policy interest rates could move materially lower next year. The strong correlation between global bonds, which have been range bound this year, and global equity markets, also appears to be broken – see chart below. Fixed income investors are perhaps less bullish on the outlook for inflation due to central banks’ previous willingness to stimulate while labour markets remain tight, and consumption being underpinned by fiscal support measures, excess savings and positive wealth effects.

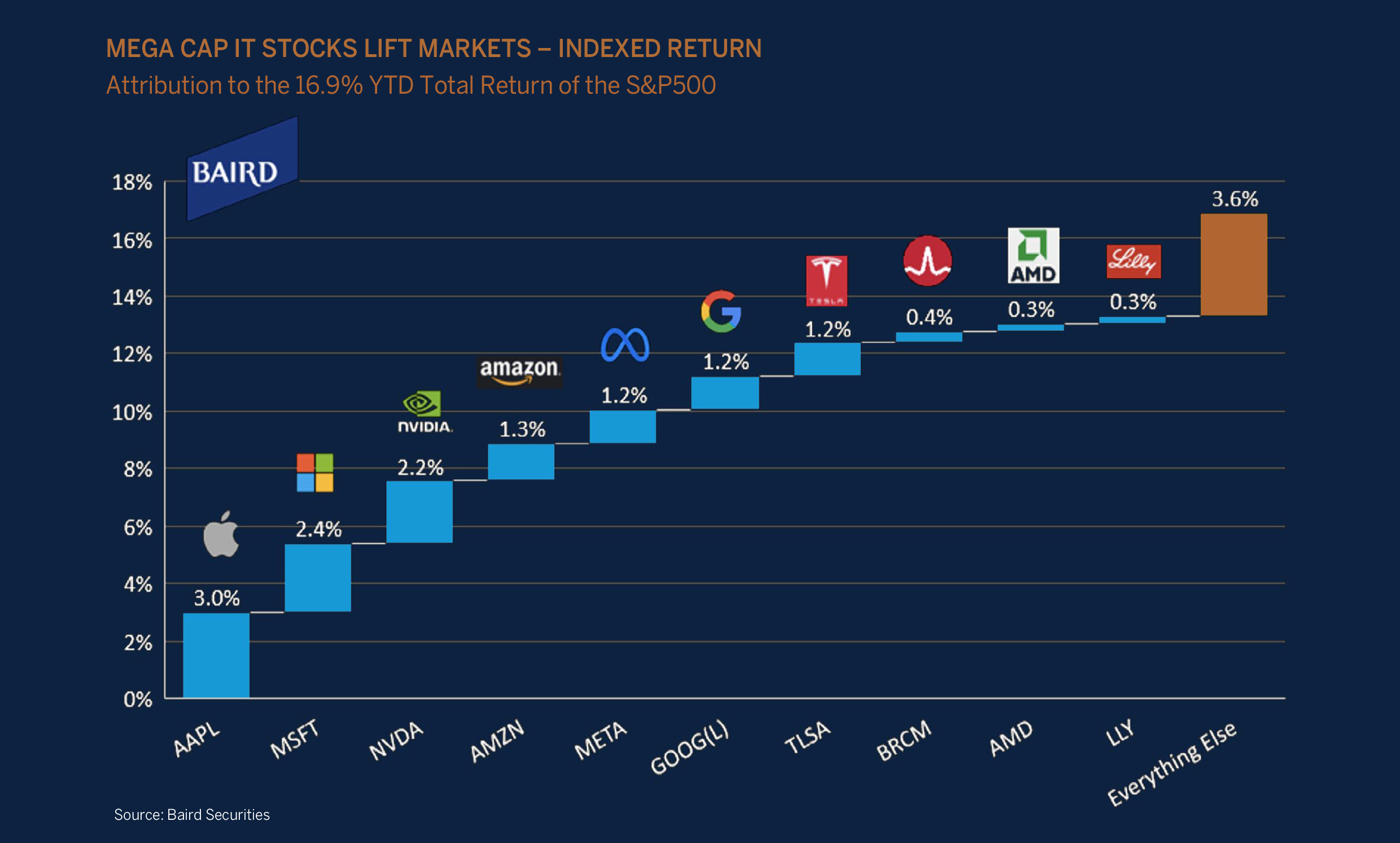

Beneath the surface, equity leadership has been incredibly narrow. It is worth noting that the strong returns from global equities are attributed to a significant rerating in valuations across mega cap tech stocks that stand to benefit from the rapid developments surrounding Artificial Intelligence (AI), as well as an improvement in risk appetite as investors position portfolios for the next upturn in the earnings cycle. The S&P 500 Index has returned around +17% this year of which c. +14% can be explained by the performance of the top 10 (mostly mega cap IT) stocks and as such has certainly not been a healthy broad-based rally that lifts most sectors and investment styles.

We believe that it is too soon to celebrate the death knell of inflation accompanied by only a slowdown in economic growth given that significant headwinds lie ahead from the lagged effects of higher for longer interest rates on consumption, investment spending and credit extension. Equity markets are positioned and priced for a “soft landing”, an environment of lower trending inflation without any significant disruption to the economy and employment market caused by the lagged effects from central banks’ monetary tightening. While such an outcome is certainly possible and some say probable, current valuations for risk assets provide little margin of safety should the economic cycle or core inflationary trends disappoint as we head into the second half of the year.

Global growth surprises to the upside, but will it be sustained?

The global economy has performed better than feared during the first half of the year. Several factors have contributed positively and have been offsetting some of the negative effects caused by higher interest rates. These include China’s recovery after three years of lockdown, lower than expected energy prices, improved functioning of supply chains after COVID-19 related disruptions and Russia’s invasion of Ukraine as well as fiscal support across developed economies. In addition, the employment market has remained robust and household balance sheets are much stronger than what was experienced during the Global Financial Crisis or even during the pandemic. Consumption has further been supported by the strong growth in asset prices which includes house prices that were up significantly since 2020. Recently, we have also witnessed a sharp bounce in housing starts in the US, an important development given the shortage in inventory and could assist in normalising house prices and the cooling of the rental market, good news for inflation down the line.

Monetary tightening on the back of elevated inflation and tight labour markets is a feature of a maturing economic cycle that is usually accompanied by vulnerabilities such as elevated private sector leverage and durable spending, as well as a sharp deterioration in corporate profit margins. None of these traditional vulnerabilities during a late cycle are currently present.

"While currently things are looking benign, there are signs of cracks starting to develop."

Conclusion

Global financial markets this year have been underpinned by better than feared economic and corporate earnings growth, and a decline in global inflation which has resulted in an improvement in real disposable income and a rerating in equity valuations. This is despite liquidity being drained from the global economy and declining money supply across developed economies. While some of the leading economic indicators are pointing to softness ahead, actual fundamental data has remained reasonably robust and is showing little sign of weakness at present. In addition, earnings revisions have turned positive, albeit marginal.

Central banks’ rhetoric remains decisively hawkish as inflation continues to be above targeted levels and as wage inflation drives consumption higher in real terms. Investors should be positioned for further interest rate hikes this year – global bond markets already are. Higher interest rates and a tightening in credit conditions will weigh on the economy. The IMF and World Bank are forecasting below trend growth for 2023/2024. The good news for investors is that although there may be recessions in some economies a global recession is not currently expected given the strength in household balance sheets and robust labour markets. A benign or “soft landing” outlook, by implication also means that investors should not expect a sharp recovery in economic momentum in the near term, as this would require a recession and/or sharply lower interest rates over the next year.

Global equity valuations are discounting a good outcome and an upturn in corporate earnings. Risks are tilted to the downside given the magnitude and pace of interest rate increases since last year, and any disappointment in expectations could result in below par returns. While cash and fixed income are providing attractive yields in the short term, we remain defensively positioned and underweight global equity on a risk adjusted basis, despite expecting a positive return over the next 12 months.

The higher yields in the bond market have allowed us to lock in attractive inflation adjusted income yields by extending duration, and we have been following a similar strategy across our short duration cash enhancement strategies. We will continue to monitor the global economic environment while keeping a close eye on valuations across asset classes and will continue to adjust the asset allocation appropriately as the environment dictates.

South Africa

Idiosyncratic events weigh on financial markets

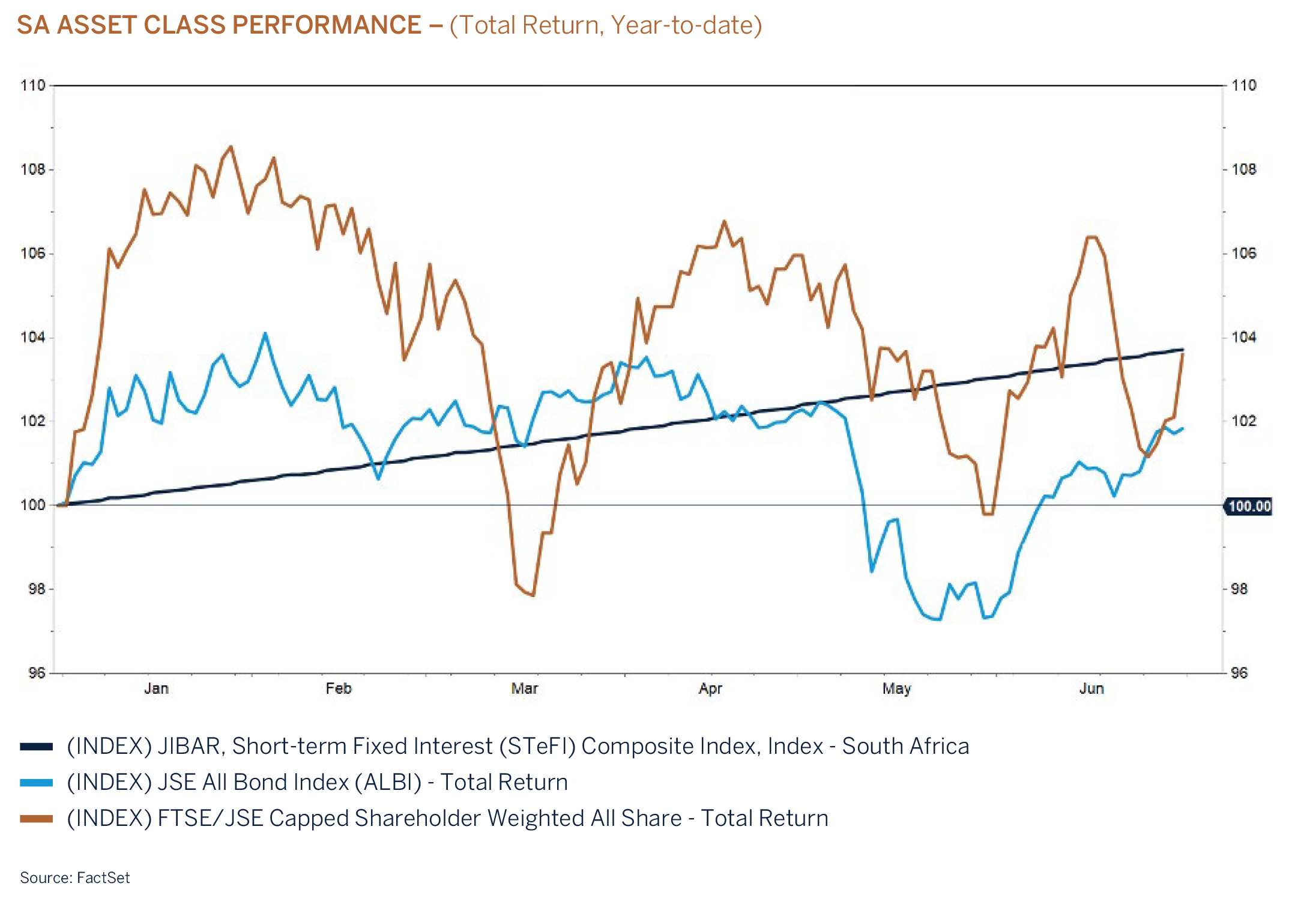

After a dismal two months at the beginning of the quarter in which politics and loadshedding dominated the news flow and sentiment in South Africa, SA assets bounced back strongly in June. Despite the improved performance towards the end of the quarter, returns from the South African equity market have been disappointing this year, especially when converted to US dollars - a reflection of persistent negative earnings revisions and deteriorating confidence across business and households over the same period. The reopening in China and an improved outlook in Europe bolstered SA assets at the beginning of the year but returns have since dwindled as Resources (ex-gold) sold off on growth concerns and lower commodity prices given China’s softer than expected economic recovery. SA’s electricity crisis and the potential threat of sanctions on the back of the Russia saga weighed on the rand, government bonds as well as domestic facing shares, with the Retail sector feeling the brunt of the pain.

While higher interest rates and elevated inflation will be a headwind to South Africa’s growth outlook in the near term, Eskom remains one of the main impediments to growth in the economy, keeping operating costs high and constraining production across the economy. Forward leading economic indicators in South Africa such as the Purchasing Managers Index remains in a contractionary state as businesses and households scramble to implement backup solutions to the power outages with generators and solar power. With the weakening rand, the input costs of running the generators will significantly affect business profits and raise the costs of imported solar supplies. In this quarter’s investment review, Kgosi Rahube comments on the recent developments at Eskom, and the parastatal’s journey and plan in finding a solution to the country’s long-standing electricity crisis.

Post a tough 1H23, a new chapter seems to have opened in June 2023, will it be sustainable?

State of Powerlessness: Look at the bright side

Let there be no doubt, 2H’22 and 1H’23 periods were in many respects challenging. If you paid attention to the headlines over the past few months, it would have been easy to conclude that:

- the sky was falling (at least economically), and

- the country was likely to be plunged into total darkness (grid failure concerns). This led to investors and SA citizens becoming increasingly nervous about the unprecedented impact of loadshedding and its adverse effects on the economy.

It suffices to say that no business is immune to the effects (directly or indirectly) of loadshedding, we highlight some of the challenges that were flagged by listed companies:

- lost trading hours and higher diesel costs by retailers,

- reduced trading densities and the acceleration of investment in renewable energy by REIT companies

- lower production and increased expenditure on diesel for mining companies

- lower network availability impacting service levels and increased capex spending for Telcos, inter alia.

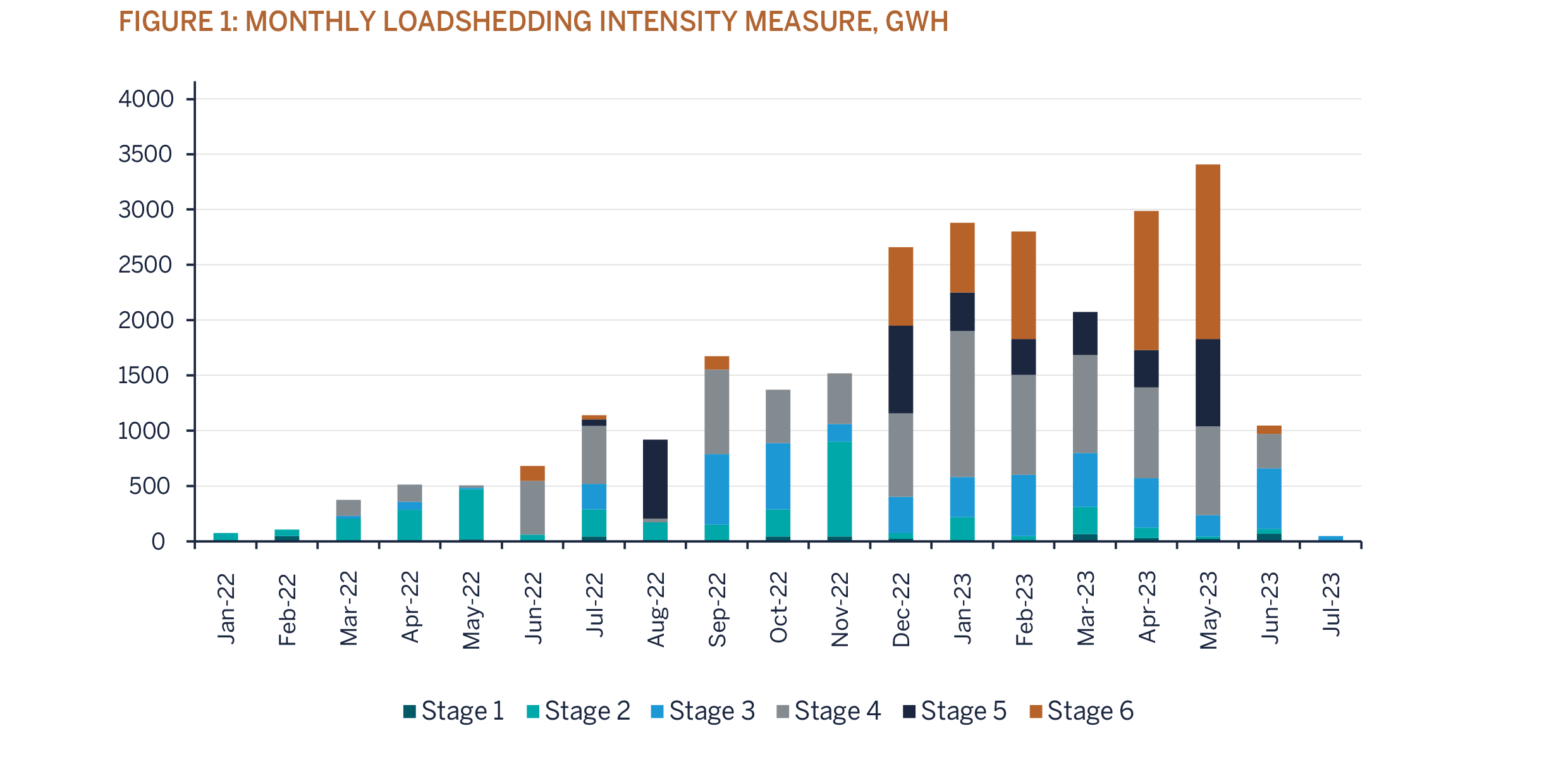

According to the South African Reserve Bank, loadshedding is expected to reduce SA’s economic output by 2% in 2023.

However, a new chapter seems to have opened in June 2023, the “powers that be” appear to have found a smidgen of power which they are graciously bestowing upon us, mere mortals. In May 2023, President Cyril Ramaphosa signed a proclamation that transfers certain powers to the Minister of Electricity, Dr. Kgosietsho Ramokgopa, interesting to note that this coincided with a power-FULL month of June. As indicated in the chart below, the intensity of loadshedding has lessened significantly from June 2023. We highlight the three key drivers that we believe led to lower stages of load-shedding:

- strong wind generation in the coast

- lower average demand thus far in winter, and

- improvements in Energy Availability Factor (EAF). Energy Availability Factor went from boom (76% in 2016) to bust (48.6% in Dec 2022), and now appears to be recovering (c60% in June 2023).

Going forward, Eskom should see the return of some of the power station units, we highlight the following:

- Kusile units 1, 2, and 3 are expected to return in Dec 2023, (a total of 2,100 MW, or 2 stages of loadshedding)

- Koeberg unit 1 (920MW) returning in Sep 2023

- Medupi unit 4 is scheduled to be online by July 2024, and Koeberg unit 2 by April 2024

The Minister of Electricity has also implemented some interventions to thwart loadshedding during winter, these include:

- strategic parts procurement (Eskom loses 2,800 MW due to lack of planning),

- coal quality improvements

- improve EAF and

- reduce unplanned breakdowns to below 15,000MW

Sabotage has also been a reality within Eskom, and this has seen trucks getting diverted to illegal coal mines to dump good-quality coal and pick up poor-quality coal (for delivery to Eskom power stations). The knock-on effect of poor coal quality is that it affects the mill (breakdowns) and leads to boiler tube leak problems. Security forces have now been deployed to deal with illegal coal mines and the arresting of syndicates involved.

Renewable energy will also be instrumental in alleviating the pressures of loadshedding, 10GW of renewable power (equivalent to 3GW of baseload generation) is likely to be operational by 2025. Investing in the transmission grid is of paramount importance to stabilise SA’s power supply and meet the growing demand for electricity. Whilst grid capacity constraints weighed on Bid Window 6, BW 7 may be a regionally focused auction (i.e. in areas where grid capacity is available, like Mpumalanga).

The looming unbundling of Eskom’s Transmission business will expedite the connectivity of renewable power. The upgrade of Eskom’s grid transmission could cost as much as R210bn in capital expenditure over the next few years and will present further opportunities for companies that manufacture high-voltage cables.

Whilst risks abound for Eskom (currently operating an ageing fleet beyond design parameters which could result in high unplanned outages), we believe that there is light at the end of the tunnel. The initiatives highlighted above, coupled with the much-anticipated return of a few power station units (a total of 4.5GW) later this year, should result in lower stages of loadshedding as early as January 2024. This makes us believe that the worst is now behind us and should thus be positive for economic growth in 2024 and the ensuing years. SA Inc. stocks have been out of favor in recent months due to the lack of power, ergo, we now see scope for some upside in some of the local listed counters. The combination of a depressed earnings base and low-cost growth for some of the counters can be enough to drive a sharp rebound in profits post-FY23e.

Staying the course

The second quarter of 2023 is a period that most South Africans would like to forget. Loadshedding occurrences reached levels that crippled the economy while confidence nosedived when it was alleged that SA supported Russia’s military efforts in Ukraine. Although the government has seemingly become more pragmatic about its relationship with Russia, presumably in response to financial markets reacting sharply and pressure from business, investors will remain concerned about the potential response from the US, which could result in the introduction of sanctions or SA losing benefits associated with AGOA.

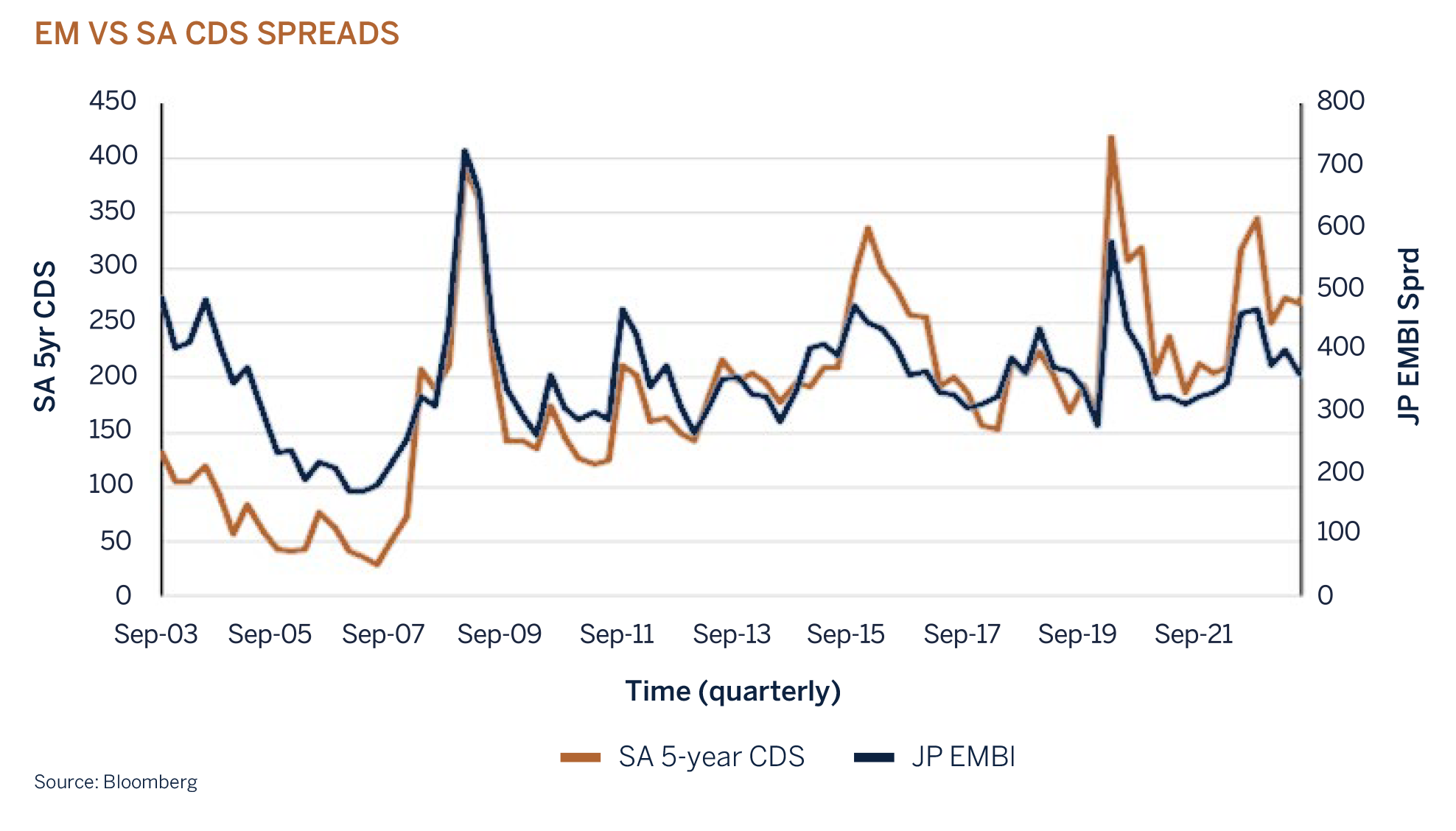

The South African economy faces significant structural growth headwinds, which if not addressed adequately will result in a continuation of pedestrian growth and the inability to put a dent in the country’s ever-increasing unemployment rate. At the same time, investors are demanding a higher rate of return on their capital (lower valuations), and this is best illustrated by South Africa’s sovereign risk spread, which has been in an upward trajectory over the past decade, not only in absolute terms but also against the emerging market peer group.

While these concerns are likely to persist in the near term, we believe that a lot of the bad news is already discounted in asset prices. SA government bond yields above 11% offer good long-term value in real terms, even when adjusting for a worsening fiscal outlook on lower-than-expected economic growth this year. The Reserve Bank has proven itself as a credible institution with a mandate to achieve long-term price stability and has an inflation target of 3-6%. Furthermore, National Treasury with support from SARS remains committed to fiscal consolidation and will adjust the government’s expenditure plan accordingly. The attractiveness of SA’s fixed income assets combined with an oversold rand will lure foreign investors back to our shores when the outlook for the global economy improves and/or once commodity prices stabilise.

Asset allocation

South African asset valuations have derated on growth concerns emanating from increased occurrences of load shedding, high interest rates, and the Russian saga which have contributed to negative earnings revisions throughout the course of the year. Consumers and corporates have degeared their balance sheets since the Global Financial Crisis (GFC) and are therefore less sensitive to domestic and global systematic risk factors that are present in the market today. Furthermore, there are no signs of excesses and/or inflated valuations across asset classes in the economy, quite the contrary. SA equities are currently trading at their lowest valuation levels since the GFC, government bond yields are offering real yields in excess of 5%, whilst the weakness of the rand may be overdone. Confidence across the economy is at depressed levels and is expected to continue to adversely weigh on economic activity and sentiment in the near term. As the SA market is currently priced for failure, it is during these pessimistic times that investment markets can provide patient investors with attractive investment opportunities that possess greater margins of safety. We, therefore, remain with our tactical overweight position to South African listed assets.

The global economy is expected to decelerate on the back of higher interest rates and further tightening in monetary policy. The risk is that central banks engineer a hard landing by overtightening to rein in stubborn inflation. Over time, higher interest rates will slow demand as the lag of monetary policy comes to fruition and banks appetite to extend credit falters as delinquencies increase. Consumer and business confidence has deteriorated due to flashing recessionary indicators and a sluggish China reopening. As we enter a Goldilocks economy, consumers will pull back on discretionary spending, whilst rising unemployment is expected to have a negative domino effect on the economy, as well as corporate profits. Valuations for global risk assets, including equities and credit appear to have run ahead of fundamentals in the short term, and at current prices provide a low margin of safety. With only the IT sector outperforming the index, the lack of market breadth in US equities echoes our decision to remain cautious in the near term. Our one-year expected top-down return for global equity is in line with the other (risk-free) asset classes, assuming a positive outcome from earnings growth over the next 12-18 months. While cash and fixed income in developed economies are providing attractive yields in the short term, we remain defensively positioned and underweight global equity on a risk-adjusted basis.

Domestic Equity – Overweight

The near-term outlook for earnings growth has deteriorated for many domestic-facing companies in South Africa given the significant cost increases associated with the electricity crisis, poor infrastructure, and service delivery, and inflated interest rates. Certain sectors such as resources will face the headwind from a reduction in lower metal prices, whilst consumer-facing stocks will have to combat the challenges associated with load shedding and higher interest rates. However, we believe that much of the negative news flow is already discounted in the share prices, even after adjusting for a higher cost of equity. Dividends are very attractive and should provide an underpin to valuations over the short to medium term. Other sectors such as Banks will continue to benefit from the endowment effect caused by higher interest rates and strong underlying credit demand from corporates that are investing in renewable energy projects, alongside the mining industry that is spending on maintenance and/or expansion of operations. Although not necessarily our base case, many industrial companies are well positioned to benefit from the expected infrastructure upgrade spend associated with water, railway lines, ports and electricity, all of which are facets of the economy we are monitoring closely for new investment opportunities. In this structurally challenging environment, we expect volatility to persist in the near term until interest rates have peaked and/or global growth concerns have stabilised. This investment environment requires caution, and our strategy remains to be invested in high-quality businesses with strong balance sheets and robust cash flow streams. With valuations at multi-year lows, we intend to stay the course by patiently remaining slightly overweight the asset class whilst receiving attractive dividend cash flows that reduce the effects of inflation in the meantime.

Domestic Bonds - Overweight

While developed market bond yields have been trading sideways to slightly higher, South African government bonds have derated sharply. Investors have become concerned about the risk of fiscal slippage given the current state of the economy. The risk premium in South Africa has risen to account for the higher-than-expected inflationary environment due to the rand’s weakness and inefficiencies in service delivery. Although execution risks remain and tax revenue is trending lower as the economy slows and capital flight transpires, the government remains committed to prudent fiscal management. We believe that inflation has peaked in the near term, and the monetary policy tightening cycle is near its zenith. Given the hawkish rhetoric emanating from the central bank, we are of the view that the bank will hike rates by a further 25- 50 basis points before pausing.

The domestic fixed income market is not immune to developments in global bond markets but given the attractive starting income yields in both nominal and inflation-adjusted terms, we would expect returns to be well above cash over the medium term, hence our overweight position to the asset class.

Global Equity - Underweight

The MSCI All Country World Index is up +14% this year, underpinned by downwardly trending headline inflation and resilient macroeconomic data (tight labour market), despite the velocity of the rate hikes over the past year. Favourable base effects from last year (supply chain disruptions now improving and energy prices easing) are currently providing a tailwind for growth, but these positive base effects are expected to normalise as the year progresses. Additionally, outside of the technology sector, equity markets have largely been trading rangebound this year, given that certain leading indicators are pointing to some softness ahead. Banks have been tightening their lending standards which have resulted in both credit extension and credit demand slowing materially, and we are now seeing corporate bankruptcies reaching the levels last seen during the GFC. Finally, the excess savings accumulated during the pandemic are expected to be “depleted” by the end of the 3rd quarter based on the current rate of consumption. At present the not-too-hot-not-too-cold view (Goldilocks) is prevailing but we prudently remain underweight the asset class for the following reasons:

- Interest rates are not expected to decline in the near term. Core inflation remains elevated given a buoyant labour market and is not expected to decline to levels that will allow central banks to cut interest rates over the next few months, as implied by the money market. Equity markets have historically not reached a bottom prior to the end of the interest rate tightening cycle and have tended to only bottom after the first interest rate cut. The risk is that monetary authorities overtighten in their effort to curb inflation.

- The full effect of higher interest rates still needs to play out. It can take up to two years before the economy fully responds to tightening monetary policy once debt is reserviced. The fusion of higher interest rates, tightening credit standards, and a decline in money supply year on year have always resulted in a recession in the past (not our base case). / The large amounts of leftover liquidity from the pandemic mean that US investors have been able to absorb the hawkish actions of the Fed. Until this liquidity is drained from the system, a near-term pivot remains unrealistic and overly optimistic by investors.

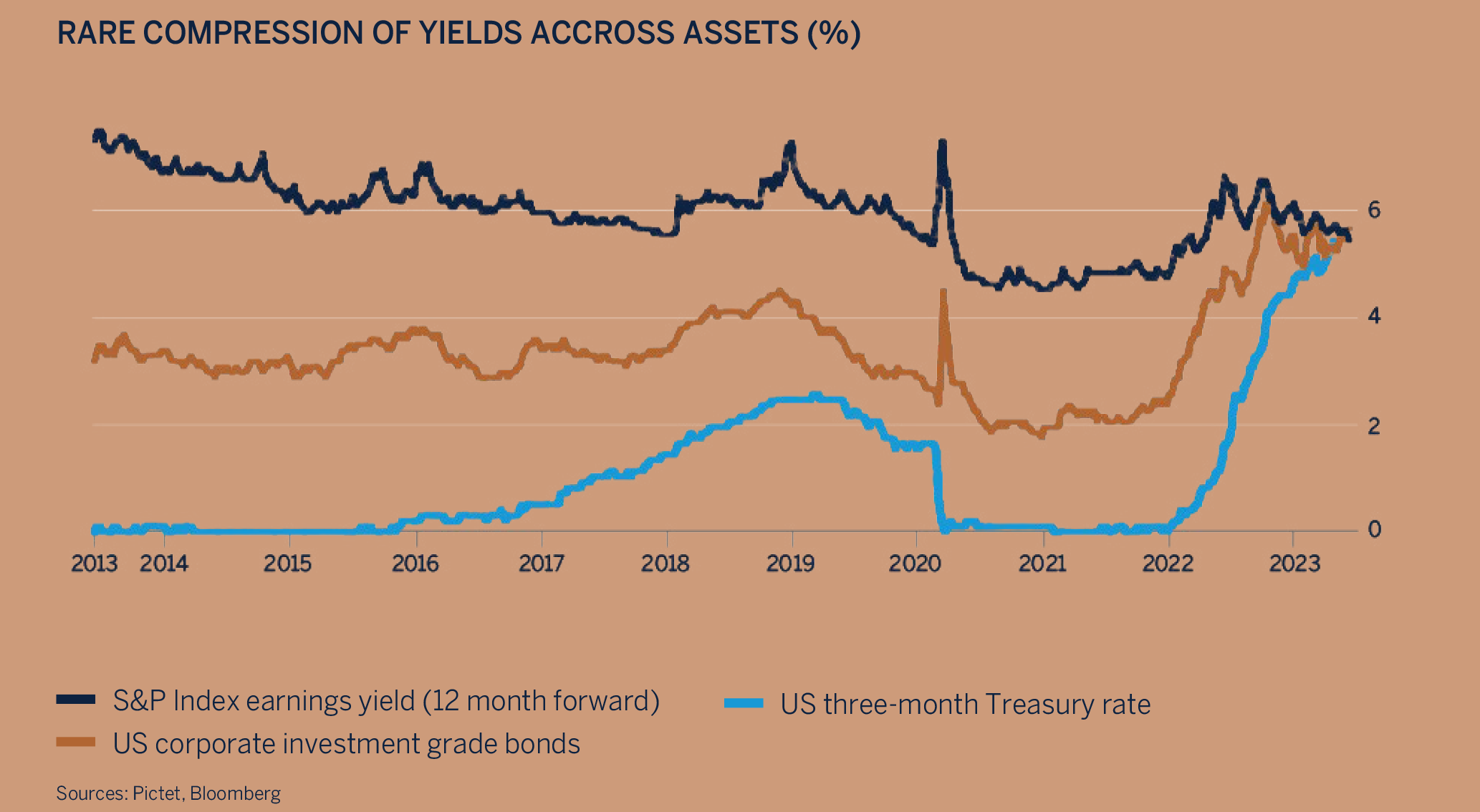

- From a valuation perspective, equities are not overly attractive on a risk-adjusted basis, and even less so when compared to the interest rates on offer for cash and government bonds. Expected returns over the next 12 months are in line with those of cash and fixed income. An environment of higher for longer interest rates and elevated inflation is unlikely to result in higher valuation multiples from current levels.

- The outlook for company earnings remains uncertain and given peak profit margins and an expectation that global growth will be timid; this may be a drag on the operating metrics of some businesses going forward.

Global Fixed Income – Underweight

Global bond markets struggled in the second quarter as higher interest rates are taking longer than forecast to dampen demand and reduce inflation towards central banks’ target levels. Headline inflation has fallen as food and energy price pressures have abated, but ongoing strong employment data continues to drive wages higher, supporting services-driven economies and, therefore, core inflation. Financial stress in March raised misplaced hopes of imminent accommodative monetary policy, but that has been replaced with the reality that more hikes are needed to bring inflation under control.

After ten consecutive hikes and a cumulative 500 basis points of tightening, the Fed kept interest rates unchanged in June. Hopes that this would mark the end of the hiking cycle were quickly erased by somewhat contradictory projections by Fed officials that at least two more increases might be necessary this year. Clearly, the Fed is opting to buy themselves more time to absorb upcoming economic releases, but with data continuing to come in stronger than expected and the inflation battle far from over, the prospect of two more hikes before year-end is very real.

At current yields, investors have an opportunity to lock in attractive real (inflation-adjusted) yields as inflation normalises over the medium term.

Global Cash Plus – Overweight

Short-term money market instruments are providing attractive yields at present in an environment where the outlook for the global economy and geopolitical environment remains precarious. These funds will naturally be deployed across the other asset classes when attractive investment opportunities present themselves.