We provide the following funds to our clients.

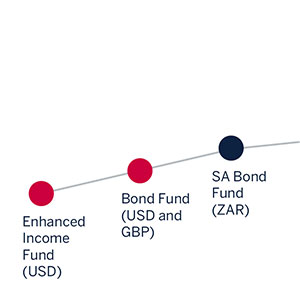

Fixed Income

Low risk profile

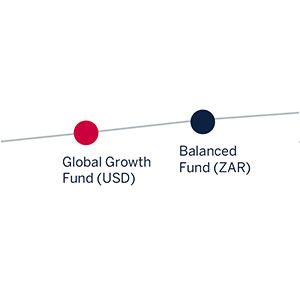

Multi-asset

Medium risk profile

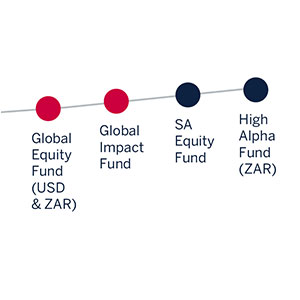

Equity

High risk profile

Why choose our funds

A range of options to suit you

This service is designed to provide a convenient, low-maintenance solution for the management of your investments

Investment performance and philosophy

You can be confident that your money is invested in the best quality companies as each fund is underpinned by our investment philosophy.

Flexibility

You can switch between strategies without charge if your circumstances or risk appetite should change.

Equity

Equities (shares in listed companies) represent an asset class that is traditionally used to deliver long-term capital growth. Over time, this asset class has consistently delivered real return in excess of other asset classes, such as fixed income and cash. This excess return, however, comes with higher volatility, particularly over shorter periods of time.

While equities carry a higher degree of volatility, at Melville Douglas, we believe that by adopting a long-term investment approach, diversifying appropriately and investing only in quality companies, the risk-reward trade-off can be substantially enhanced for long-term investors.

Our funds are suitable for investors seeking exposure to the equity market with maximum capital appreciation as their goal over the long term. Investors in equity funds should have a tolerance for short market volatility in order to achieve long-term objectives and must be willing to hold their investment for at least five years.

High Alpha Fund SA Equity Fund Global Equity Feeder FundMulti-asset

Our multi-asset funds aim to provide broad diversification across a range of asset classes, global markets and investment strategies to provide stable capital growth over the long term. We recognise that a single asset class rarely performs well in all market conditions, and so the best way to deliver real returns and reduce risk is through diversification.

At Melville Douglas, we recognise that equities are the riskiest asset class, but they do have the potential to provide higher returns and are an essential portfolio component for long-term investors seeking a real return on their investment. Our multi-asset fund strategies therefore have a higher allocation to growth assets, but also incorporate other asset classes such as debt and income-generating securities.

Our multi-asset funds are suitable for investors seeking capital growth over the longer term at a moderate risk.

Balanced Fund

Fixed income

Fixed-income funds, as the name suggests, allow investors to draw an income from their investment. Income funds are often seen as one dimensional. However, they can prove beneficial as part of a diversified portfolio by reducing volatility, creating a buffer against inflation and even growing the portfolio through income investments such as bonds and dividend-paying equities.

Most importantly, a diversified income portfolio can generate income at a lower level of risk than equities, and tends to offer higher income than money market funds or term deposits.

Our income funds are suited to investors who are looking for managed exposure to income-generating instruments, and who want to take advantage of active management within the fixed-interest universe.

SA Bond Fund